Decentralized Finance (DeFi) is revolutionizing how we interact with money, allowing anyone to earn yield on their crypto assets without traditional banks. This guide breaks down the three core pillars of DeFi—staking, lending, and providing liquidity on exchanges—explaining how they work, the yields you can expect, and the risks involved. We’ll navigate the essential layers of blockchains, applications, and assets to give you a clear, actionable roadmap for getting started.

The Three Foundational Layers of DeFi

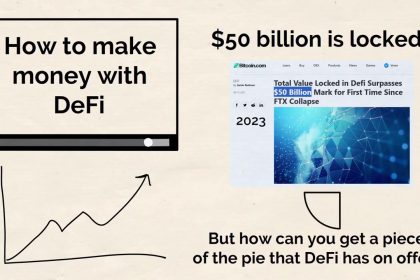

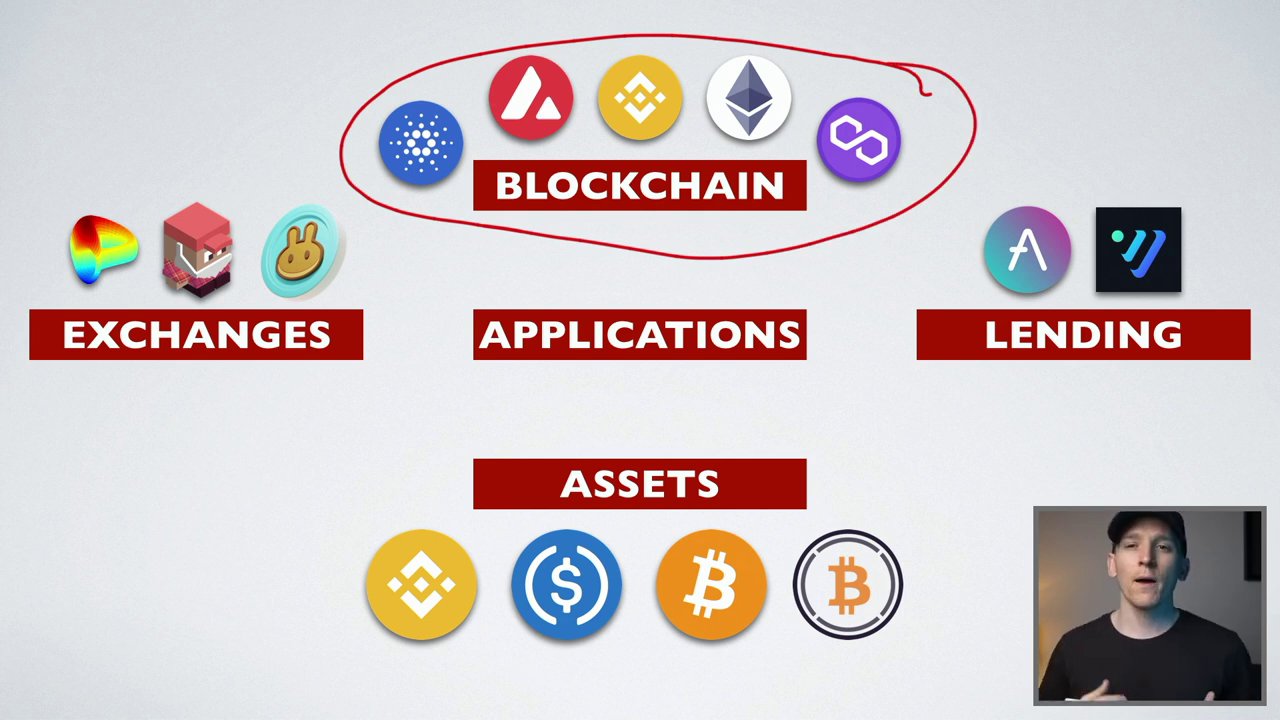

To understand how to earn yield, you first need to grasp the infrastructure. The crypto world for DeFi can be split into three interconnected layers: blockchains, applications, and assets.

The first layer is blockchains. We’re specifically talking about smart contract blockchains like Ethereum, Polygon, BNB Smart Chain, and Avalanche. These are the foundational networks. Smart contracts are the key innovation; they are self-executing code that enshrines an agreement. This code enables decentralized finance because it allows you to enter a financial contract with a stranger anywhere in the world without needing to trust them personally—you only need to trust the code.

Built on top of these blockchains are applications. These are the protocols and platforms you interact with, such as decentralized exchanges (DEXs) and lending platforms. They are built with smart contract code, enabling functions like lending your assets to earn interest or providing liquidity to earn trading fees. In traditional finance, you might pay a bank or an exchange a fee for these services. In DeFi, you can be the bank and earn those fees yourself.

The third layer is assets. Smart contract chains can host a wide variety of digital assets. This includes stablecoins like USDC or USDT (digital versions of the US dollar), the native tokens of each blockchain (like ETH or BNB), and even wrapped versions of assets from other chains, like Bitcoin (WBTC). This means you can use Bitcoin in DeFi strategies on Ethereum or other chains to generate yield.

Pillar 1: Staking – The Foundation of Proof-of-Stake

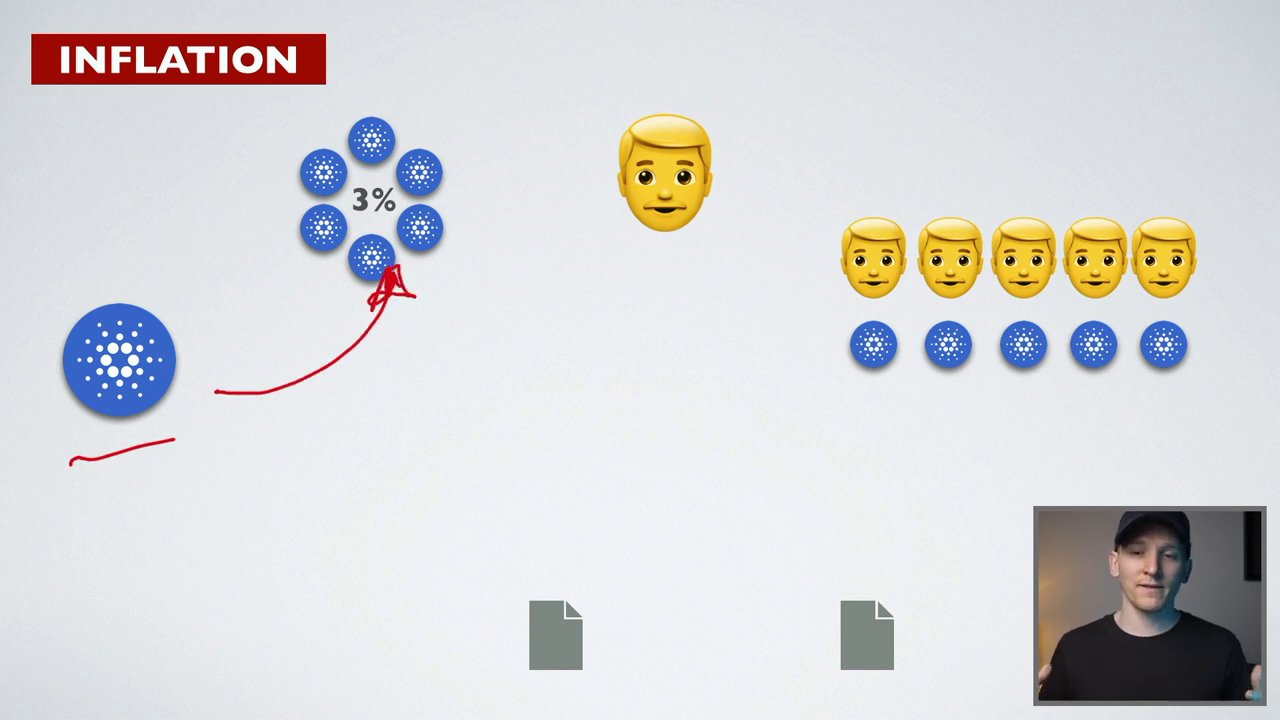

Staking is often the first and simplest entry point into earning yield. On proof-of-stake blockchains, you can “stake” your native tokens (like ETH, ADA, or MATIC) to help secure the network. In return, the protocol pays you staking rewards.

- Standard Staking: This involves directly locking your tokens with the blockchain’s protocol. It’s a low-technical-risk option with reliable, though often modest, returns. You don’t have to rely on third-party smart contracts, but your staked tokens are typically illiquid.

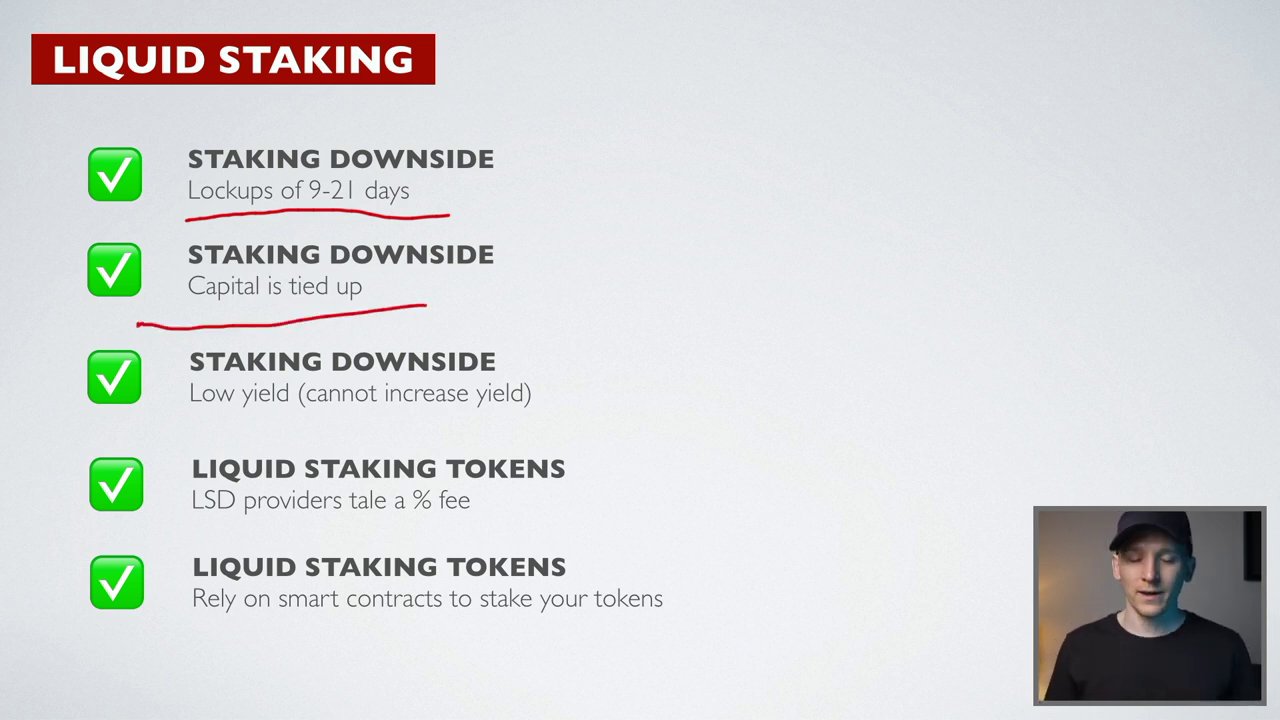

- Liquid Staking: This is a step above standard staking. Protocols like Lido or Rocket Pool allow you to stake your tokens and receive a liquid staking token (e.g., stETH) in return. This token represents your staked asset and its accrued rewards. The key advantage? You can use this liquid token in other DeFi applications to compound your earnings, a process at the heart of yield farming.

Pillar 2: Lending – Becoming the Bank

Lending in DeFi allows you to be the lender. You deposit your assets into a lending platform like Aave or Compound, and others borrow them, paying you interest. The foundational mechanism that makes this trustless is over-collateralized lending.

How does it work? A borrower must deposit collateral worth more than the loan they take. For example, to borrow $700, they might need to lock up $1,000 worth of Ethereum. This creates a safety buffer. If the value of their collateral falls close to the loan value, the smart contract automatically liquidates (sells) some of it to repay part of the loan, protecting the lender’s funds.

This over-collateralization is why DeFi lending is considered relatively low risk compared to other strategies; the loan is always backed by more value than is lent out.

You can lend out various assets, from stablecoins to Ethereum. Yields vary by asset, blockchain, and platform. For instance, lending USDC on Avalanche might pay 3%, while on Polygon it pays 2.35%. Platforms often offer additional incentive tokens to attract liquidity, which can be automatically harvested and sold to boost your overall yield using “yield optimizer” platforms like Beefy Finance.

Pillar 3: Exchanges & Providing Liquidity – Earning Trading Fees

This is where DeFi’s innovation shines. On decentralized exchanges (DEXs) like Uniswap or PancakeSwap, you can become a Liquidity Provider (LP). Instead of just paying a fee to trade, you can earn fees from other people’s trades.

Here’s how it works: You deposit a pair of assets (e.g., ETH and USDC) into a liquidity pool. This pool enables all trading for that pair on that exchange. Every time someone makes a trade, they pay a small fee (e.g., 0.3%), and that fee is distributed proportionally to all LPs in the pool. This turns your idle assets into a fee-earning machine.

The potential upside is significant, but it introduces new risks like impermanent loss—a temporary loss that occurs when the price of your deposited assets changes compared to when you deposited them. It’s “impermanent” because it can be reversed if prices return to your entry point, but it becomes a permanent loss if you withdraw when prices are divergent.

Getting Started: Wallets, Risks, and Building a Strategy

To interact with any DeFi application, you need a self-custody wallet. This is software where you control your private keys, unlike on a centralized exchange. The most common is MetaMask, an EVM-compatible wallet that works with Ethereum, Polygon, BNB Smart Chain, and others. Coinbase Wallet is another popular choice. You’ll need to download one, fund it with crypto from an exchange, and connect it to DeFi applications.

Each blockchain has different characteristics. Ethereum is highly secure but can have high transaction fees. Layer 2 solutions (like Arbitrum, Optimism) and competitors like Polygon and Avalanche offer much cheaper fees but may involve different trade-offs in security or decentralization. Liquidity and yields are also “siloed” by chain, meaning you need to explore opportunities on each network separately.

Your strategy depends entirely on your risk tolerance:

– Lowest Risk/Reward: Standard staking. Reliable, minimal smart contract exposure.

– Moderate Risk/Reward: Lending on established platforms like Aave. Over-collateralization provides a strong safety net.

– Higher Risk/Reward: Providing liquidity (LPing) and advanced yield farming. This involves combining strategies (e.g., using a liquid staking token as collateral for a loan, then using that loan to provide liquidity) to maximize yield. This introduces more platform risk and smart contract risk.

It’s crucial to use only battle-tested protocols that have operated securely for years. The complexity and potential rewards of yield farming are explored in depth in our guide, The Builder’s Blueprint: A Systematic Approach to Finding High-Yield DeFi Liquidity Pools.

Conclusion: Your Path Forward in DeFi

DeFi democratizes finance, turning users into active participants who can earn yield through staking, lending, and providing liquidity. Start by understanding the three-layer stack of blockchains, apps, and assets. From there, choose your entry point based on comfort: begin with simple staking, explore the relative safety of over-collateralized lending, or dive into providing liquidity to earn trading fees.

Remember, higher potential yields always come with increased complexity and risk. Always do your own research, start small, and use reputable, time-tested protocols. The journey into DeFi is a step-by-step process of building knowledge and confidence. For those looking to apply these principles in a more gamified environment, the concepts of earning through participation are also core to the emerging world of play-to-earn crypto games.

By mastering these core pillars, you unlock the ability to put your crypto assets to work, generating passive income in the new, open financial system.