Welcome to the world of decentralized finance (DeFi), where your capital can start working for you, even with a modest starting point. This guide is designed for anyone with around $250 who wants to explore two fundamental DeFi strategies: lending and providing liquidity. We’ll walk through simple, actionable setups on popular platforms, comparing the pros and cons of each approach to help you decide where to begin based on your goals for cash flow or price appreciation.

Understanding the Two Core DeFi Vehicles

At the heart of many DeFi portfolios are two primary platforms: lending protocols and decentralized exchanges (DEXs). Each serves a different purpose and offers a unique risk-reward profile.

Lending platforms operate on a principle similar to a traditional bank but in a decentralized manner. You, as a capital provider, deposit your assets. Others can then borrow those assets, paying an interest fee. A portion of that fee is paid to you, the supplier. This model allows you to earn a yield simply by holding your assets on the platform.

Decentralized exchanges, like Uniswap or Orca, facilitate token swaps. When you provide liquidity to a pool, you are essentially supplying the trading pairs (e.g., ETH/USDC) that allow users to swap between assets. In return for this service, you earn a portion of the trading fees generated by the platform. This strategy is often the cornerstone of more advanced systems, like the strategies discussed in The Builder’s Blueprint: A Systematic Approach to Finding High-Yield DeFi Liquidity Pools.

The key trade-off is straightforward:

– Lending is better for maintaining single asset exposure and potential price appreciation.

– Liquidity Pools are typically better for generating cash flow, but they introduce more complex dynamics like impermanent loss.

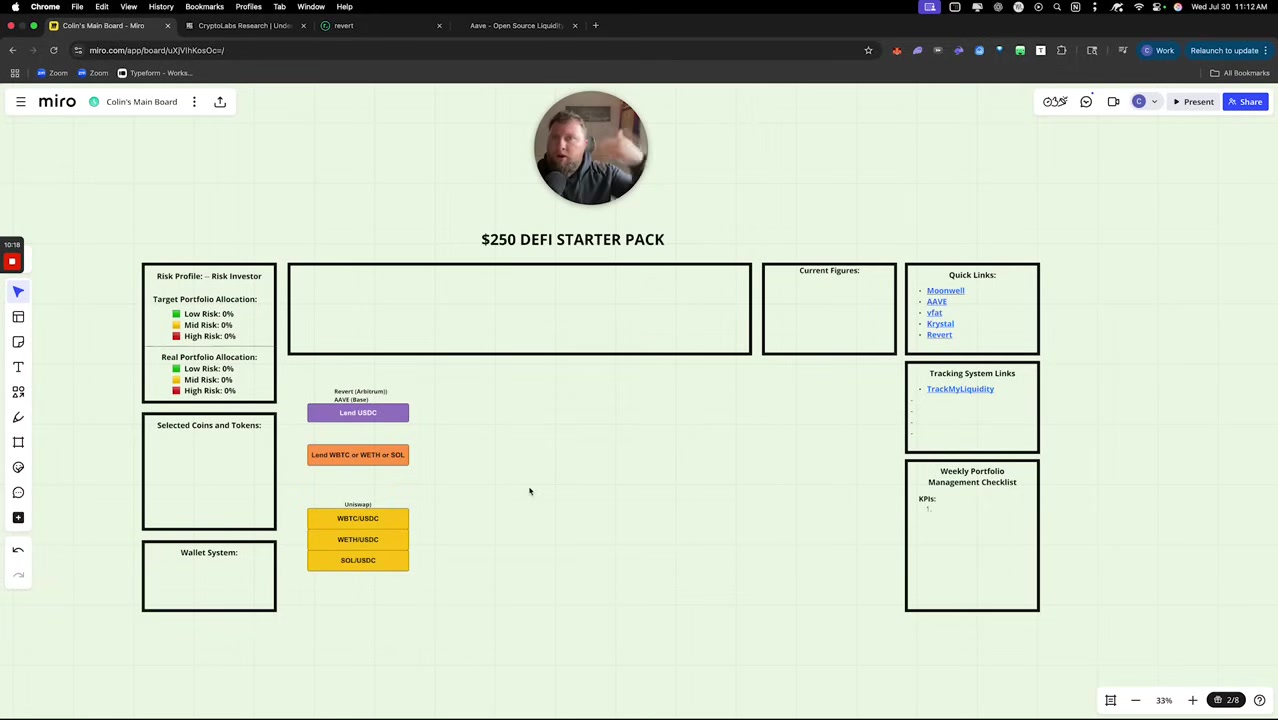

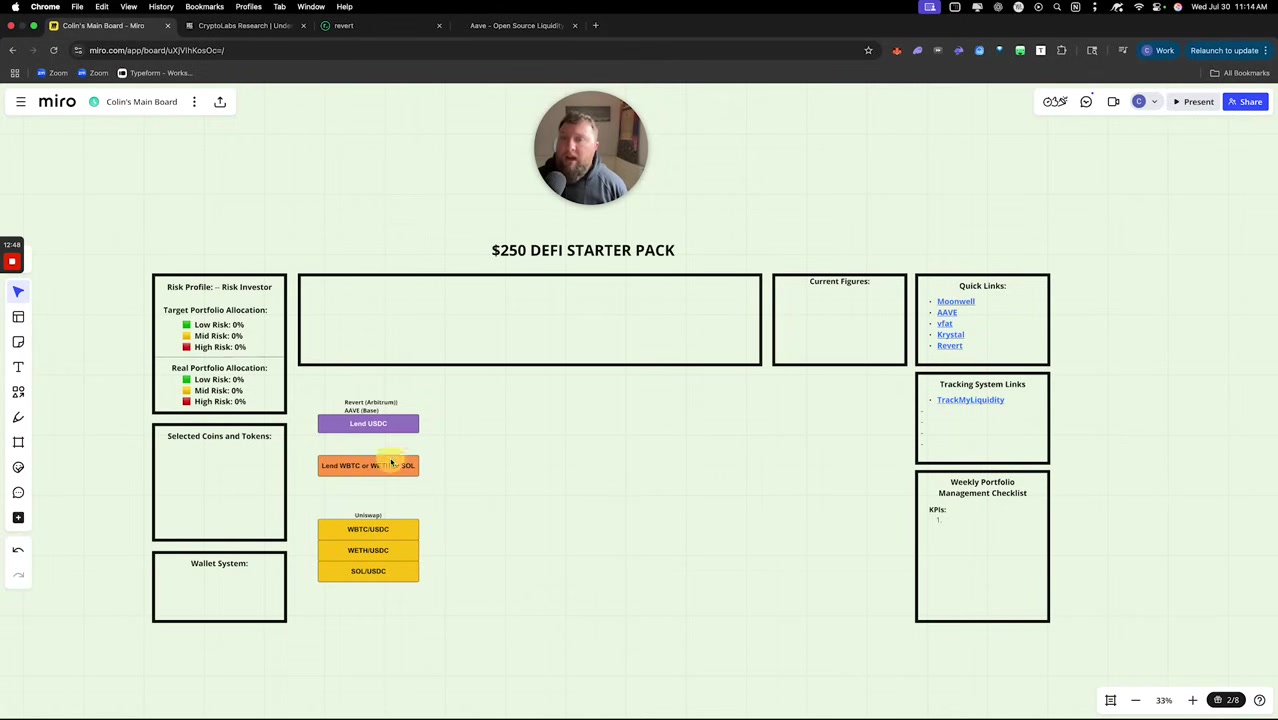

Strategy 1: Conservative Lending with Stablecoins

If your primary goal is to minimize risk while earning yield, lending stablecoins is an excellent starting point. This approach involves no directional risk on volatile crypto assets; you’re simply earning interest on a dollar-pegged asset like USDC.

Platform 1: Aave – The Established Giant

Aave is one of the largest and most reputable decentralized lending platforms. For a beginner seeking a conservative entry, it’s a top choice. On the Base network, for example, supplying USDC can earn you a variable yield—recently around 5.62% APY. The platform’s massive total value locked (TVL), often in the billions, offers a sense of security and established operation.

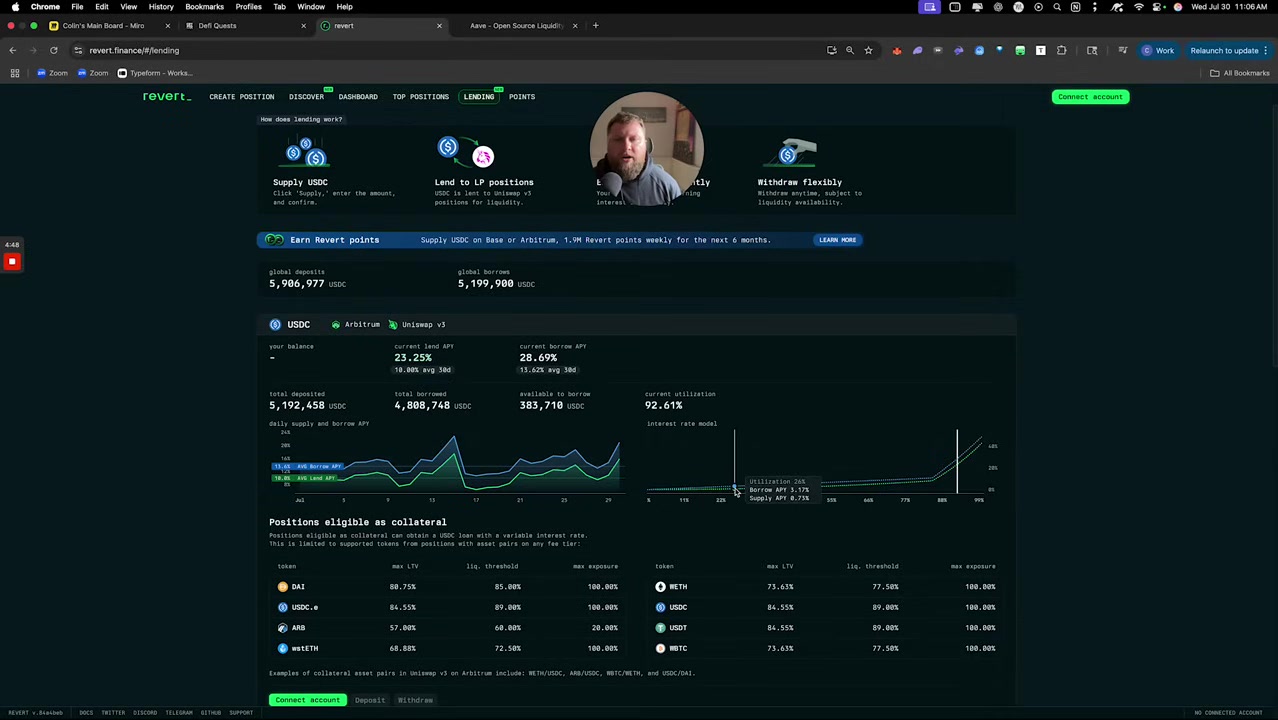

Platform 2: Revert – For Elevated (But Variable) Yields

For those willing to accept slightly more platform risk for potentially higher returns, newer protocols like Revert can offer elevated rates. These rates are highly variable and depend on the utilization rate—the ratio of borrowed funds to supplied funds. A high utilization rate drives up the supply APY.

Recently, Revert showed a USDC supply APY as high as 23%, but its 30-day average was around 10%. It’s crucial to understand that these spikes are temporary. The platform is smaller than Aave (with millions in TVL versus billions), which contributes to both its higher potential yields and its higher risk profile.

The Takeaway: For a true beginner with $250 who wants a “set and forget” conservative strategy, depositing USDC into a major lending platform like Aave is a solid way to start earning DeFi yield with minimal complexity.

Strategy 2: Lending Volatile Assets for Price Appreciation

Lending isn’t only for stablecoins. You can also lend assets like Bitcoin (BTC), Ethereum (ETH), or Solana (SOL). The mechanics are the same, but the motivation shifts.

- The Reward: You continue to hold full exposure to the asset. If Bitcoin’s price rises, the value of your lent Bitcoin rises accordingly. You also earn a lending yield on top of that, though it’s generally lower than stablecoin rates.

- The Strategy: This is ideal if you are bullish on a particular asset and want to hold it long-term but would like to generate a small amount of extra yield from your holdings. It’s a passive strategy that combines “HODLing” with earning.

An advanced iteration of this is using your lent assets as collateral to borrow against. This allows you to access liquidity without selling your appreciating asset, which you can then deploy into other yield-generating strategies. This “flywheel” effect is a powerful DeFi concept for more experienced users.

Strategy 3: Liquidity Pools for Maximizing Cash Flow

When your primary mission is cash flow, liquidity pools on decentralized exchanges become the preferred vehicle. Here, you provide two assets to a trading pair, such as ETH/USDC.

How It Works (The Travel Analogy):

Think of traveling from the US to Europe. You need to exchange USD for EUR. At a bank, you pay a fee for this service. On a DEX, users swap tokens and pay a small fee. That fee is distributed to you, the liquidity provider. You are essentially acting as the market maker, facilitating trades and earning the spread.

The Potential and The Catch:

The cash flow from liquidity pools can be significant, often ranging from 30% to 80% APR or higher. This is where you can truly amplify the yield on your $250 starter pack.

However, this high cash flow comes with a major trade-off: impermanent loss (IL). In simple terms, IL means you won’t experience 100% of the price appreciation you would have if you just held the two assets separately. If one asset in the pair skyrockets in value relative to the other, the pool’s automated mechanism rebalances your position, resulting in a “loss” compared to simply holding.

Beginner Advice: If you’re starting with $250, it’s wise to begin with a stablecoin-to-crypto pair like ETH/USDC. Avoid starting with crypto-to-crypto pairs (e.g., BTC/ETH), as understanding the price correlation and dynamics between two volatile assets adds a layer of complexity best tackled after mastering the basics.

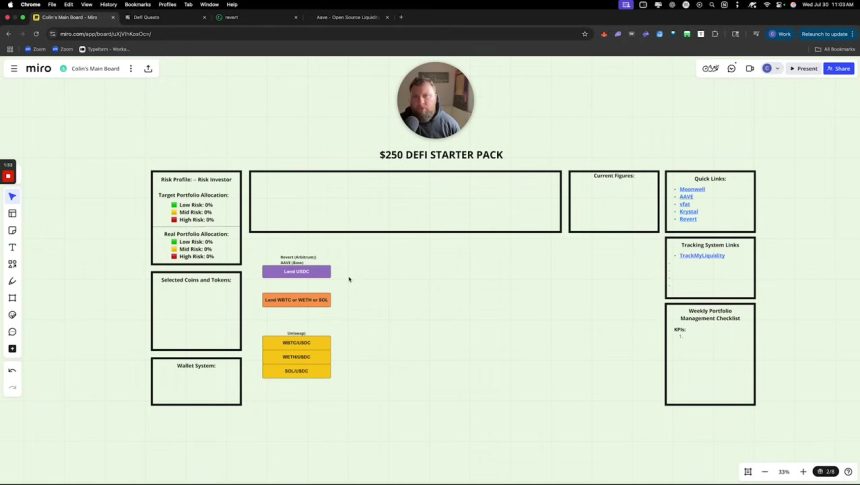

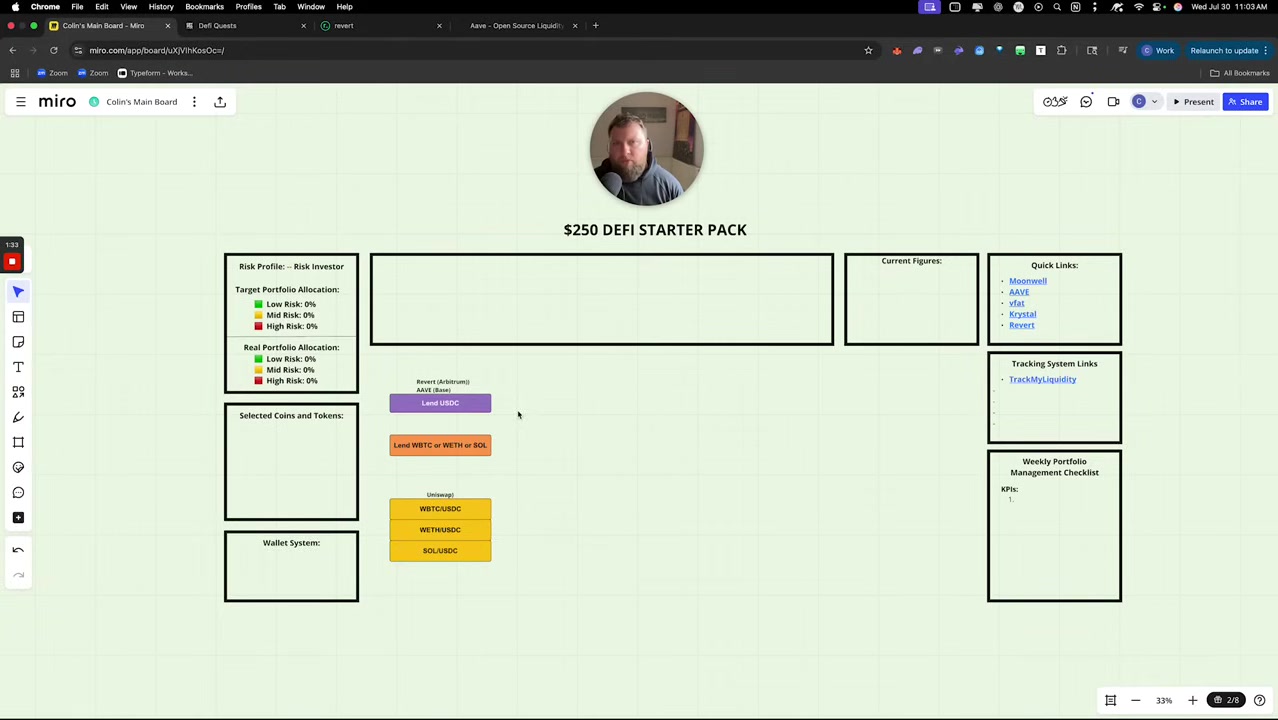

Building Your $250 DeFi Starter Portfolio

So, where should you put your $250? The answer depends on your goal, but a balanced approach for a beginner might look like this:

- Define Your Primary Goal: Is it capital preservation and steady yield or maximizing cash flow?

- Choose Your Platform Mix:

- For conservative yield: Allocate a portion to USDC lending on Aave.

- For cash flow focus: Allocate a portion to a stablecoin pair (e.g., ETH/USDC) on a reputable DEX like Uniswap.

- For price appreciation with a yield bonus: Consider lending a small amount of a crypto asset you believe in long-term.

- Start Simple and Learn: Don’t try to implement advanced, leveraged strategies on day one. Use your $250 as a learning fund. Experience the process of connecting your wallet, making a deposit, and watching your rewards accrue.

The beauty of DeFi is that these basic building blocks—lending and liquidity provision—can be combined into more sophisticated, automated yield strategies as you grow more confident. The journey from a simple starter pack to a complex, interlocking DeFi system is a rewarding path of financial education.

Conclusion and Key Takeaways

Starting your DeFi journey with $250 is not only possible but a practical way to learn by doing. The two core strategies offer clear paths:

- Lending Platforms (like Aave & Revert): Perfect for single asset exposure. Use them for conservative stablecoin yield or to earn a little extra on assets you plan to hold for price appreciation.

- Liquidity Pools (on DEXs like Uniswap): The go-to for high cash flow, but require an understanding and acceptance of impermanent loss. Start with simple stablecoin pairs.

Your first step is to decide which outcome aligns with your current financial goals. You can even split your funds to test both waters. The most important thing is to take that first step, start small, and build your knowledge from there. The decentralized financial world is built for participation, and with these tools, you can begin providing a service and getting rewarded for it today. For those looking to expand their earning horizons beyond DeFi, exploring other crypto niches like The Solana Play-to-Earn Explosion: Your Guide to the Top 5 Games Right Now can offer additional avenues for engagement and reward.