Welcome to the dynamic world of decentralized finance, or DeFi. With over $50 billion locked in the ecosystem as of mid-2023, this burgeoning sector is offering compelling alternatives to traditional finance. But how can you, as an individual, tap into this potential and make your crypto work for you? This guide will walk you through three primary methods: straightforward staking, advanced leverage staking, and becoming a liquidity provider.

The Foundation: Understanding Crypto Staking

At its core, staking is a simple yet powerful concept. It involves holding your cryptocurrency assets in a specific wallet or smart contract to support the operations of a blockchain network. In return, you earn a share of the rewards from the transactions processed on that network. It’s a way to generate passive income without actively trading your assets.

Getting started is often straightforward. For example, if you want to stake Ethereum on a platform like Binance, you would first need to have ETH in your wallet. You can purchase it directly with a credit card or transfer existing holdings. Once your deposit is ready, you navigate to the platform’s “Earn” section, select ETH Staking, choose your amount, and confirm. The process is designed to be user-friendly.

The Pros and Cons of Staking

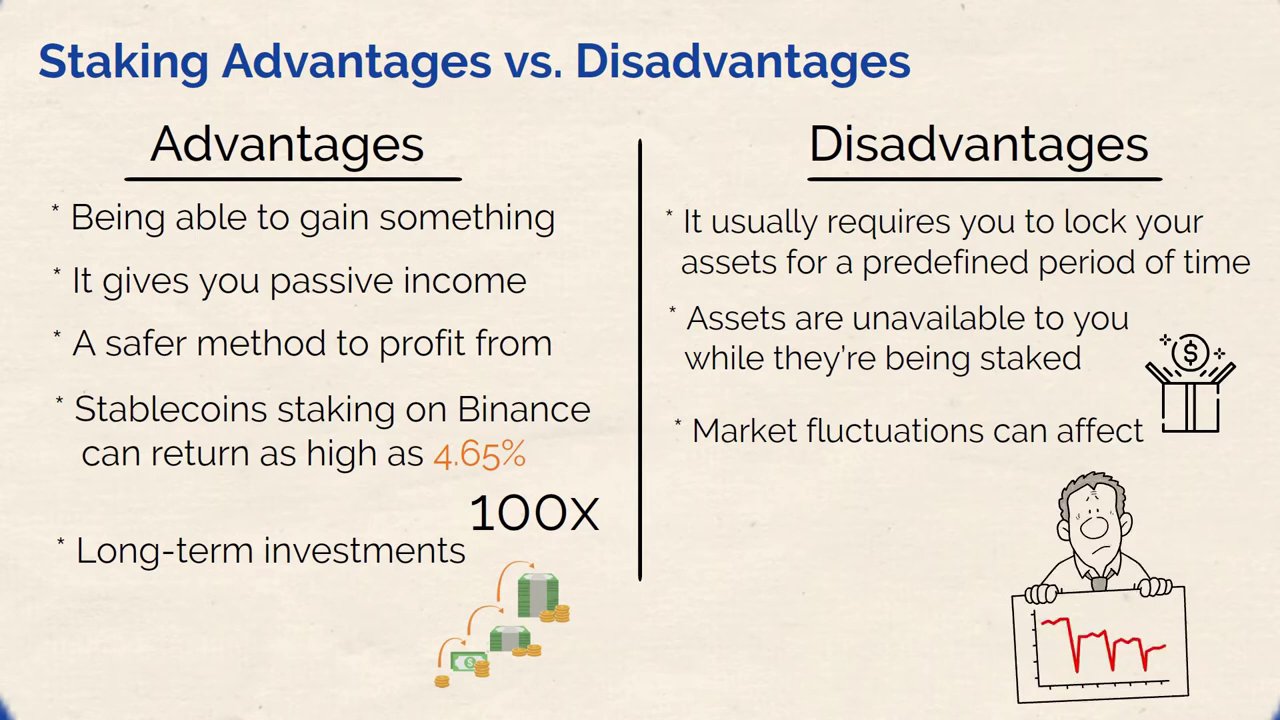

Like any financial strategy, staking comes with its own set of advantages and considerations.

The Benefits:

– Passive Income Generation: The most significant advantage is earning rewards simply for holding and locking your assets.

– Potential for Safer Returns: It can offer a more predictable return, especially with stablecoins. For instance, stablecoin staking on Binance has offered returns as high as 4.65%—dwarfing traditional high-yield savings accounts.

– Compounding Rewards: Over time, your rewards can be re-staked, allowing your returns to compound and grow, similar to long-term traditional investments.

The Downsides:

– Lock-Up Periods: Your assets are typically unavailable for a predefined period while they are being staked.

– Market Volatility: The value of your staked crypto and the rewards can be significantly affected by market fluctuations. Since cryptocurrency is a highly volatile asset, this can impact your overall returns.

While staking is an excellent entry point, it’s just the first layer of the DeFi opportunity.

Amplifying Returns: An Introduction to Leverage Staking

For those looking to potentially increase their yields, leverage staking presents a more advanced strategy. This method involves borrowing additional funds from a decentralized protocol and using those borrowed assets to stake even more. In essence, you’re using your initial investment as collateral to amplify your staking position.

A popular platform for this strategy is Lido. When you stake Ethereum on Lido, you don’t just lock it away. Instead, you receive stETH (staked Ethereum) tokens in return. These tokens are liquid and hold the same value as regular ETH, but they represent your staked position. This liquidity is the key to leverage.

Here’s a simplified step-by-step:

1. Stake your Ethereum on Lido to receive stETH.

2. Convert your stETH to a “wrapped” version (wstETH) for easier use across different DeFi networks.

3. Take your wstETH to a lending protocol like Aave and deposit it as collateral.

4. Borrow Ethereum against that collateral. Using a common loan-to-value ratio, you might borrow 5 ETH for every 10 wstETH you deposit.

5. You can then take this newly borrowed Ethereum and restart the cycle by staking it again on Lido.

This creates a recursive loop where you use your original Ethereum to access more Ethereum for staking, potentially multiplying your rewards. This principle can also be applied to stablecoins for potentially more stable, though sometimes lower, returns.

Weighing the Risks and Rewards of Leverage

The primary benefit of leverage staking is clear: it allows you to expand your investment pool without committing additional personal capital. You’re using borrowed funds to generate more income.

However, the risks are proportionally higher. The most significant danger is related to impermanent loss and liquidation. If the market value of your collateral falls below a certain threshold relative to your loan (the loan-to-value ratio), the protocol may automatically sell (liquidate) your collateral to cover the debt. This can result in a permanent loss of your initial assets. For a deeper dive into managing these complex dynamics, our guide on finding high-yield DeFi liquidity pools offers a systematic approach to risk assessment.

Becoming a Market Maker: Earning as a Liquidity Provider

The third primary method to earn in DeFi is by acting as a liquidity provider (LP) on a decentralized exchange (DEX). DEXs like Uniswap, SushiSwap, and PancakeSwap need users to deposit pairs of tokens (e.g., ETH and USDC) into liquidity pools to facilitate trading. In exchange for providing this essential service, LPs earn a share of the trading fees generated by that pool.

The process typically involves these steps:

1. Choose a DEX that supports the token pair you’re interested in.

2. Connect your Web3 wallet (like MetaMask) to the exchange.

3. Ensure you have both assets in the pair. If you only have Ethereum, you may need to swap a portion of it for the paired token (like USDC) first.

4. Navigate to the “Pool” section, create a new position, and deposit an equal value of both tokens into the chosen liquidity pool.

5. You will often need to set a “fee tier” and a price range for your liquidity, which determines how and when your funds are used by traders.

Once deposited, you can earn passive income from the trading fees. The more your specific liquidity is used by traders within your set price range, the more fees you accumulate.

The Liquidity Provider’s Balance Sheet

Providing liquidity offers a direct way to earn from market activity. Key benefits include generating passive fee-based income and sometimes earning additional platform rewards or tokens. Furthermore, by cutting out intermediaries, DEXs often allow you to keep a larger portion of the fees.

However, it’s not without challenges. The two main concerns for LPs are:

– Volatility: The value of your deposited tokens will fluctuate with the market.

– Impermanent Loss: This occurs when the price ratio of your deposited tokens changes after you’ve added them to the pool. If one token significantly outperforms the other, you may end up with less value than if you had simply held the two tokens separately. This is a critical concept to understand before providing liquidity.

For those interested in applying similar earning principles in a different context, the play-to-earn model in gaming offers another avenue. You can explore options like browser-based games or top mobile titles that allow you to generate rewards.

Conclusion: Your Path Forward in DeFi

The world of decentralized finance offers multiple pathways to put your cryptocurrency to work. You can start with the relative simplicity of staking to earn passive rewards on your holdings. For those comfortable with more complexity and risk, leverage staking provides a method to amplify potential returns by borrowing against your assets. Finally, by becoming a liquidity provider, you can earn a share of trading fees and act as a crucial pillar for decentralized exchanges.

Each method carries its own balance of potential reward and risk, from market volatility and lock-up periods to the nuanced challenge of impermanent loss. The key is to start with a clear understanding, perhaps beginning with straightforward staking before exploring more advanced strategies. With over $50 billion already flowing through DeFi protocols, the tools are there—it’s about learning how to use them wisely to make your money work for you.