When cryptocurrency markets take a downturn, investors often face a difficult choice: sell at a loss or hold on for the long haul. But what if you could hold your assets, avoid selling at a loss, and still earn rewards even during a market correction? This is the powerful opportunity presented by crypto staking, a method to passively grow your holdings. Platforms like Crypto.com have made this accessible through programs like Crypto Earn, allowing you to earn weekly rewards on a wide array of coins, turning idle assets into a source of consistent income.

What is Crypto Staking and How Does It Work?

At its core, crypto staking is a process where you lock up your cryptocurrency holdings for a preset period to support the operations of a blockchain network or, in the case of exchanges, to provide liquidity. In return for this service, you earn rewards. Think of it like earning interest in a high-yield savings account, but for your digital assets.

On the Crypto.com platform, this is facilitated through their Crypto Earn program. When you hold your crypto on their exchange, you’re helping increase the platform’s liquidity. As a result, the platform offers users competitive reward rates. Essentially, you’re being compensated for contributing your assets to the ecosystem’s stability and functionality.

The fundamental mechanism is straightforward: you commit your coins for a chosen term, and the platform pays you rewards, typically calculated as an annual percentage yield (APY). The actual rate you earn depends on several key factors, which we will explore next.

Navigating the Crypto.com Earn Program: Rates, Terms, and Flexibility

Crypto.com’s Earn program is designed with user flexibility in mind, offering various options to suit different investment strategies. Currently, you can earn up to 14.5% annually on a growing selection of cryptocurrencies and up to 10% on stablecoins.

Choosing Your Staking Term

One of the program’s key features is the choice of three distinct holding terms:

– Flexible Term: Allows you to withdraw your staked assets at any time. This option offers the most liquidity but generally comes with lower reward rates.

– One-Month Term: You lock your coins for a one-month period. This term offers higher rewards than the flexible option.

– Three-Month Term: This is the longest commitment, locking your assets for three months. In exchange for reduced liquidity, it provides the highest reward rates available in the program.

The principle is simple: the longer you commit your coins, the higher your potential rewards. This structure incentivizes long-term holding, which can be particularly advantageous during volatile market phases.

Supported Cryptocurrencies

The program supports an extensive and growing list of over 50 different cryptocurrencies and stablecoins. This includes major assets like:

– Bitcoin (BTC)

– Ethereum (ETH)

– Dogecoin (DOGE)

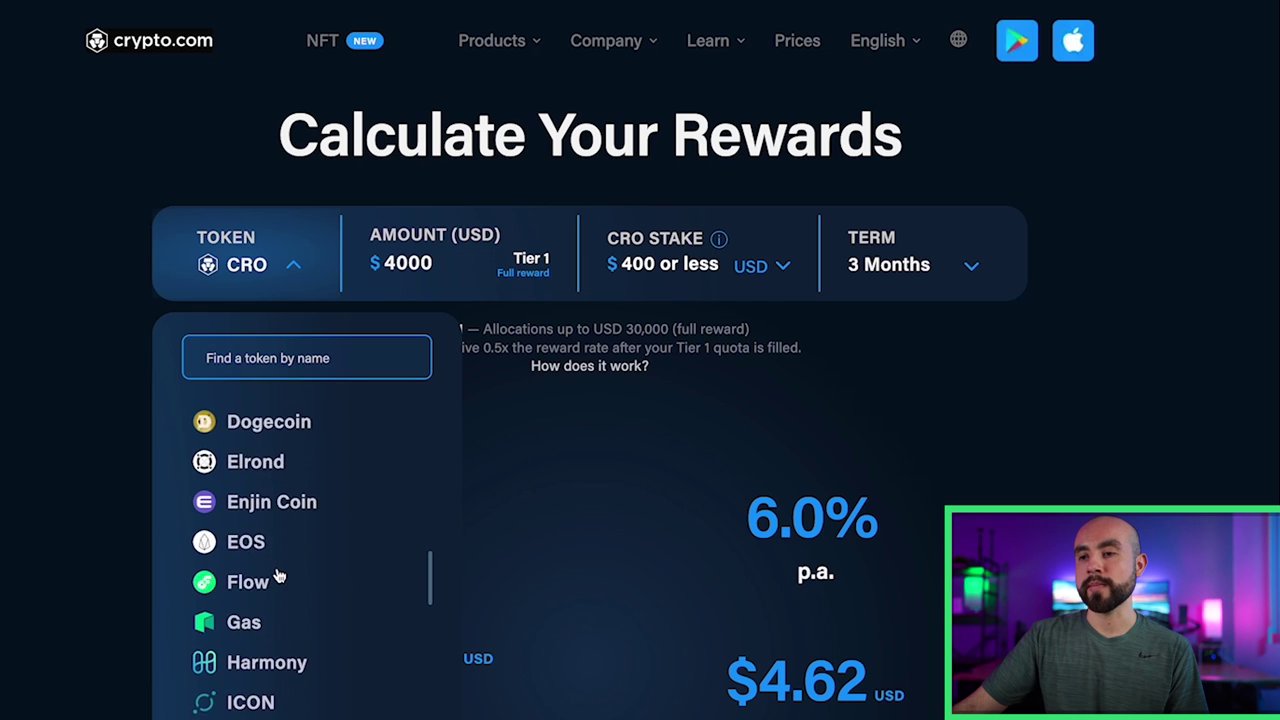

– Cronos (CRO) – Crypto.com’s native token

– USD Coin (USDC)

– Tether (USDT)

This diversity allows you to earn rewards on a wide portion of your portfolio, not just a single type of coin.

How Rewards Are Calculated and Paid

Understanding the reward payout structure is crucial for setting accurate expectations. Crypto.com has designed its system to provide regular, transparent income.

Weekly Payouts in Kind

One of the most appealing features is the frequency of payments. You receive your rewards every seven days. Furthermore, you are always paid in the same cryptocurrency that you staked. For example:

– If you stake Bitcoin, your weekly rewards are paid in Bitcoin directly to your Crypto.com Bitcoin wallet.

– If you stake USD Coin, you receive more USD Coin.

This “in-kind” payment means your rewards compound in the asset you believe in, potentially increasing your exposure as its value grows.

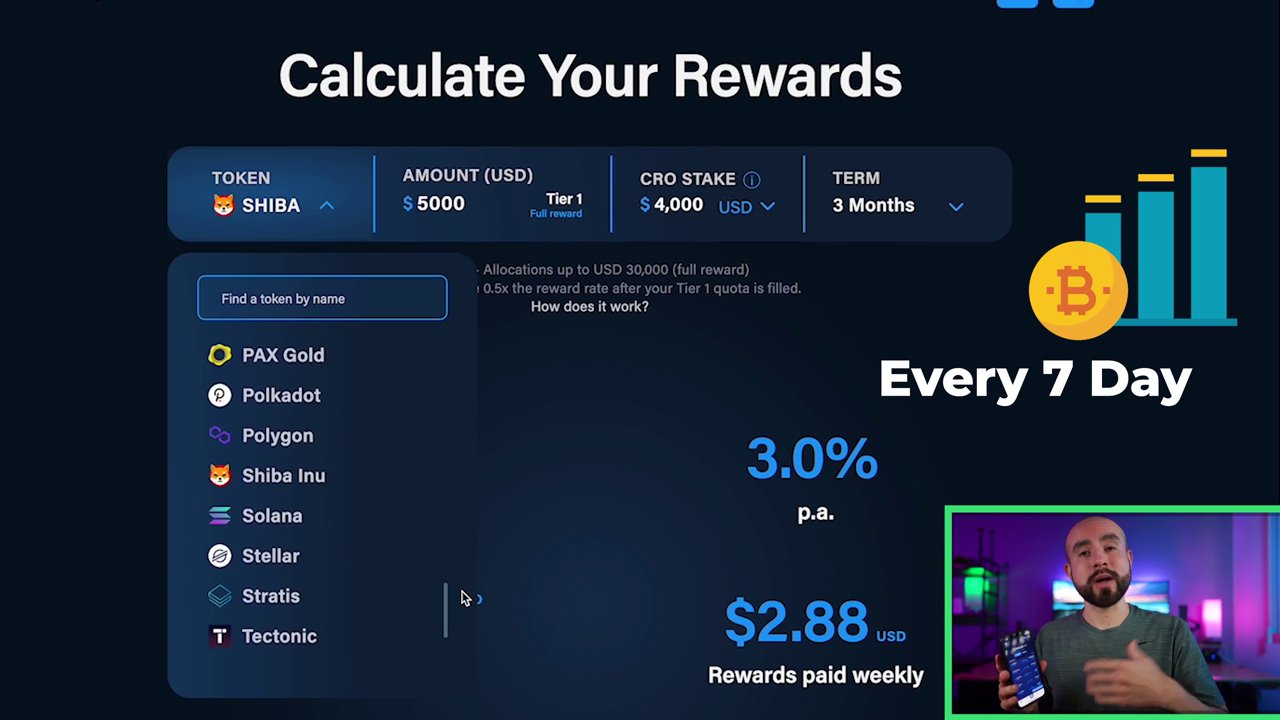

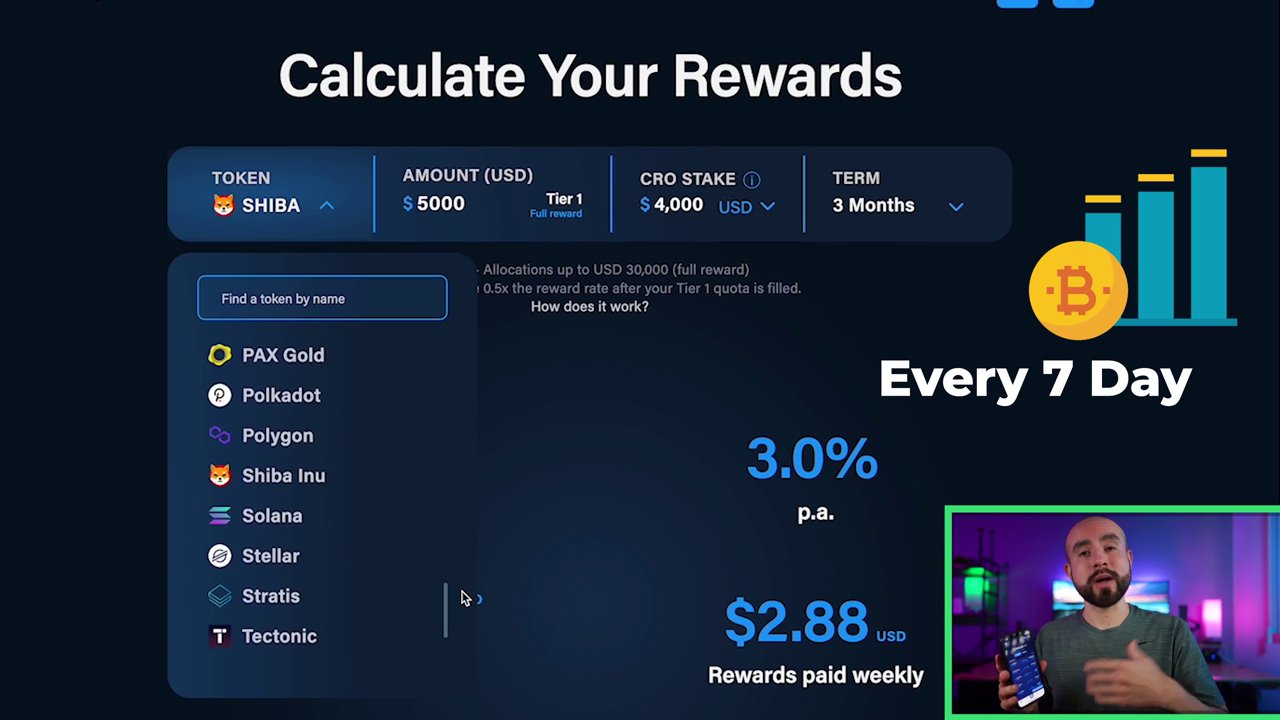

Using the Crypto.com Calculator

To help users forecast potential earnings, Crypto.com provides a handy calculator on their website. This tool allows you to model different scenarios by inputting:

1. The cryptocurrency you wish to stake (e.g., Dogecoin, Bitcoin, Ethereum).

2. The USD-equivalent amount you plan to stake.

3. Your chosen deposit term (Flexible, 1 month, or 3 months).

4. Whether you are staking additional CRO, which can influence rates, especially in conjunction with their Visa card tiers.

For instance, staking $5,000 worth of Dogecoin for a three-month term might generate an estimated $100 USD per year in rewards, paid out as roughly $1.92 worth of Dogecoin each week. This calculator demystifies the process and helps in financial planning.

Is Crypto Staking Right for You? Weighing the Pros and Cons

Crypto staking, particularly through a program like Crypto Earn, is not a one-size-fits-all solution. Its value depends heavily on your personal investment goals and strategy.

When Staking Makes Sense

Staking is an excellent strategy for long-term investors (“HODLers”) who plan to hold their assets through market cycles. Instead of letting coins sit idle in a wallet, staking allows these assets to generate a passive income stream. This can be especially powerful during market declines, as it provides a positive return even when portfolio values are down, effectively lowering your average cost basis over time.

Furthermore, you don’t have to stake your entire portfolio. A balanced approach is to stake a portion of your crypto for long-term rewards while keeping another portion liquid for trading opportunities. This gives your portfolio exposure to both steady income and trading flexibility.

Considerations and Limitations

If your strategy revolves around short-term trading, locking up your coins for one or three months may not be ideal, as it reduces your ability to react quickly to market movements. The staking commitment requires forethought and aligns with a patient, long-term outlook.

It’s also vital to remember that this is an educational overview, not financial advice. All investments carry risk, including the potential loss of principal. The rewards rates are variable and subject to change based on market conditions and platform policies.

Getting Started and Complementary Features

If you’ve decided to explore crypto staking, getting started with Crypto.com is straightforward. New users can often benefit from sign-up bonuses, such as a $25 bonus when joining through a referral link, providing a small boost to begin your earning journey.

Crypto.com’s ecosystem also includes other valuable products that complement the Earn program. Their Visa debit cards are particularly notable. These cards allow you to spend your cryptocurrency anywhere Visa is accepted while earning crypto cashback on purchases. The rewards from these cards, especially at higher tiers that require staking CRO, can work in tandem with your Crypto Earn rewards, creating a comprehensive system for earning on both your holdings and your spending.

Conclusion: Turning Market Patience into Profit

Crypto staking via programs like Crypto.com Earn presents a compelling strategy for navigating the inherent volatility of cryptocurrency markets. It transforms the traditional “hold and wait” approach during downturns into an active “hold and earn” strategy. By offering flexible terms, weekly payouts in kind, and competitive rates on a wide range of assets, it provides a practical tool for generating passive income.

The key takeaway is to align staking with your investment horizon. For the long-term believer, it’s a way to put idle assets to work, earning rewards that can compound over time. By understanding the terms, using the available tools to calculate potential earnings, and possibly combining it with other ecosystem features like the crypto Visa card, you can build a more resilient and productive cryptocurrency portfolio. In the world of crypto, patience isn’t just a virtue—with staking, it can be a profitable strategy.