Crypto is finally going mainstream, and stablecoins are leading the charge. Spurred by major corporate entries and landmark legislation, these digital dollars are moving from the fringes of finance to its very core. This article explores the corporate rush into stablecoins, the regulatory landscape taking shape, and the profound implications for the global financial system.

The Corporate Gold Rush into Digital Dollars

The landscape of digital assets is undergoing a seismic shift, moving away from speculative volatility toward utility and stability. The catalyst? A wave of traditional finance and corporate giants placing massive bets on stablecoins. This isn’t just about crypto enthusiasts anymore; it’s about JP Morgan, Walmart, Amazon, and Visa recognizing the transformative potential of blockchain-based payments.

The public market debut of Circle, the issuer of the USDC stablecoin, was a watershed moment, unlocking billions in investor demand and signaling maturity for the sector. This was quickly followed by a flurry of activity: Coinbase partnered with Stripe and Shopify to bring USDC payments to merchants worldwide; payments firm By-serve announced a stablecoin to pair with its 90 billion annual transactions; and even retail behemoths Walmart and Amazon are reportedly exploring their own tokens.

Why this sudden corporate fervor? Proponents see stablecoins as the next evolution in money movement, akin to the creation of credit card networks decades ago. As one payments executive noted, “We are a payments company, and we saw the potential of this technology to bring the next generation of payment rails… it was absolutely too important for a payments company not to have a horse in the race.” The promise is immense: faster, cheaper, 24/7 transactions that could decimate the $187 billion in transaction fees card issuers raked in during 2024.

Understanding the Engine: What Are Stablecoins?

Unlike the wild price swings of Bitcoin or the speculative nature of many NFTs, stablecoins are designed for one purpose: stability. They are cryptocurrencies pegged to the value of another asset, most commonly the US dollar. Think of them as a digital representation of a dollar that can be moved instantly between wallets, businesses, or across borders without traditional banking intermediaries.

They maintain their peg through reserves. For every dollar-pegged stablecoin in circulation, the issuer holds a corresponding reserve of real dollars or cash equivalents like U.S. Treasuries. The two giants are Tether’s USDT and Circle’s USDC, which together have over $217 billion in circulation. A key distinction lies in their regulatory approach: Tether operates globally from outside the U.S., while Circle is under the New York regulatory umbrella, primarily targeting U.S. customers.

The utility is compelling. For consumers, they enable cheap, instant cross-border remittances, providing a lifeline for the unbanked and an alternative to volatile local currencies in emerging markets. For businesses, they offer a way to settle payments instantly, day or night, and potentially slash crippling payment processing fees. This foundational technology is what’s driving the current “utility phase,” where the tech is mature enough for real-world adoption. While the user experience for earning in gaming is evolving in spaces like play-to-earn crypto games, stablecoins are becoming the bedrock for value transfer in those ecosystems.

Regulation and Risk: The Double-Edged Sword

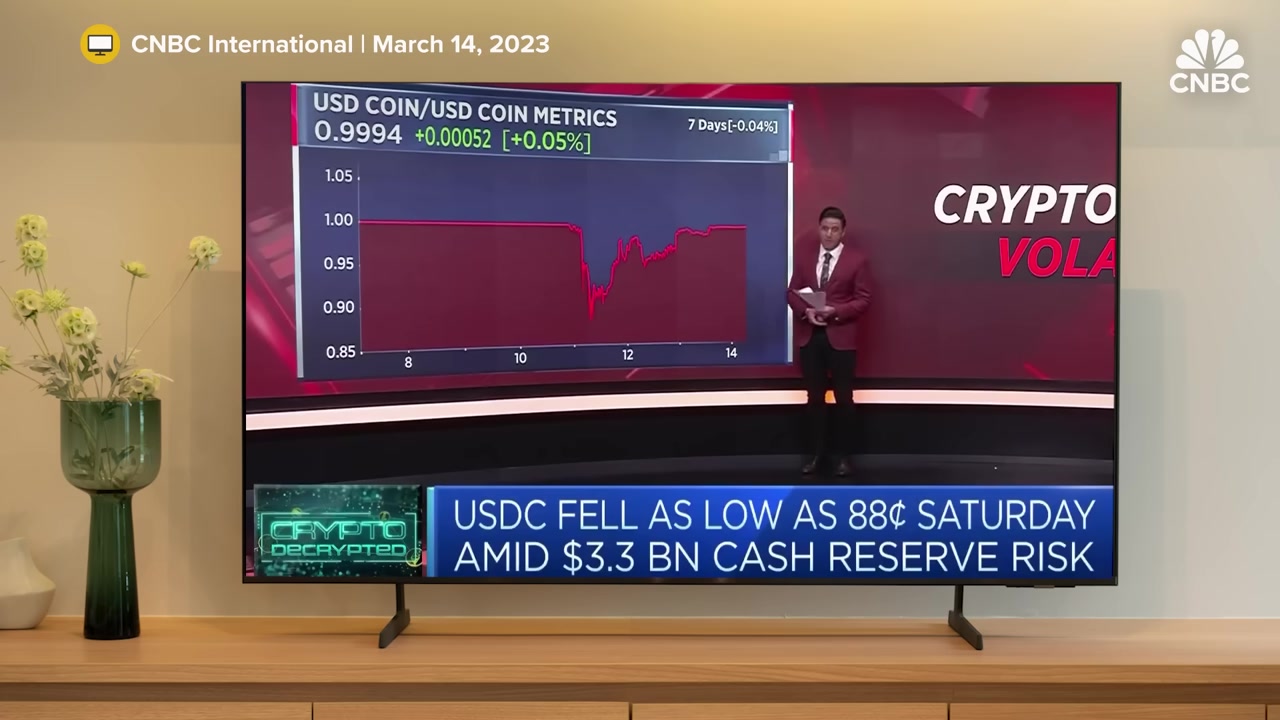

The rapid embrace of stablecoins is not without significant concerns, prompting lawmakers to act. The 2022 collapse of the Terra-USD stablecoin, which snowballed into a broader crypto market crash, and the 2023 de-pegging of USDC following the Silicon Valley Bank collapse, exposed critical vulnerabilities. Critics warn that stablecoins could threaten financial stability and, unlike regulated money market funds where investors might lose “a penny or two on the dollar,” could theoretically fall to zero.

There are also persistent worries about illicit finance, with the U.S. Treasury noting risks of sanctions evasion and money laundering. Furthermore, under proposed legislation, stablecoin issuers are banned from paying yield to customers, meaning any interest earned on the underlying reserves would be pocketed by the issuer rather than passed to the holder—a point of contention for consumer advocates.

In response, the U.S. Senate has advanced the Lummis-Gillibrand Responsible Financial Innovation Act (the “Genius Act”) with bipartisan support. The bill aims to provide crucial regulatory clarity by establishing:

– Consumer protection provisions

– Strict reserve and annual audit requirements for issuers

– Authority for the Treasury to designate non-compliant foreign issuers

Treasury Secretary Scott Bessent has testified that a well-regulated stablecoin market could unlock a $2 trillion opportunity and even help manage the national deficit by creating a new, reliable class of buyers for U.S. Treasuries. As traditional buyers like China and Japan become net sellers, stablecoin issuers have emerged among the top ten buyers of Treasuries, a trend expected to grow.

The Future of Payments: Disruption or Integration?

So, what does the future hold? The entry of corporate giants suggests a hybrid model of disruption and integration. While Walmart and Amazon exploring their own tokens spooked traditional payment networks, causing stock slides for Visa and Mastercard, the incumbents are not sitting idle. They are actively working to co-opt the technology.

Visa is modernizing its settlement infrastructure with stablecoins and enabling credentials on top of them. Mastercard has partnered with stablecoin issuer Paxos to enable multiple stablecoin transactions on its network. As one analyst observed, “Visa and MasterCard are leaning into the disruption. They’re trying to disrupt themselves.”

The vision is a financial system where stablecoins operate “in the water supply”—as invisible infrastructure powering faster, cheaper transactions behind the scenes. Most users may never know they’re interacting with a stablecoin; it will simply be the way value moves. This infrastructure could power everything from corporate treasury management, as seen with JP Morgan’s JPM Coin for institutional settlements, to seamless global e-commerce and remittances.

The path forward hinges on the final regulatory framework. The Genius Act, while a major step, leaves questions unanswered, particularly around consumer yield and potential conflicts of interest, as highlighted by critics like Senator Elizabeth Warren. The industry’s ability to build trust through transparency and robust reserves will be paramount.

Conclusion: A New Financial Infrastructure Takes Shape

The stablecoin narrative has decisively shifted from “if” to “how.” We are witnessing the foundational layers of a new financial infrastructure being laid by the most established names in business and finance. Driven by the dual engines of corporate efficiency-seeking and legislative action, stablecoins are poised to become a core component of global finance.

The potential benefits are vast: a more inclusive financial system, radically cheaper and faster cross-border payments, and new efficiency for businesses. However, these benefits are balanced against real risks concerning stability, consumer protection, and illicit activity that regulation must carefully address. One thing is clear: the race to define the future of money is on, and stablecoins are at the starting line. Their integration into the mainstream will be one of the most significant financial stories of the coming decade, reshaping how everyone, from gamers earning in browser-based play-to-earn games to multinational corporations, moves value around the world.