The crypto gaming narrative, once hailed as the next great mass onboarding event for Web3, has fallen into a state of deep disillusionment. From the dizzying highs of 2021 to the sobering reality of late 2025, the sector is grappling with a 99.9% failure rate, vanishing VC interest, and a fundamental question: can it be saved? This article dissects what went wrong and explores a potential, radical solution for the future.

The Promise and the Peak

In the latter part of the 2021 bull market cycle, crypto gaming wasn’t just a trend; it was the narrative. Axi Infinity’s explosive success painted a vivid picture of a future where play-to-earn mechanics could onboard millions. The vision was grand: blockchain would revolutionize gaming by giving players true ownership of their in-game assets, creating vibrant, player-driven economies. Influencers, analysts, and investors alike were swept up in the belief that this would be the catalyst for mainstream crypto adoption.

The initial successes seemed to validate the hype. Beyond Axi, projects like Gunzilla had fantastic initial runs. In 2024, titles like Mavia and Pixels entered the scene with strong momentum, demonstrating that engaging gameplay could coexist with blockchain elements. Early products like Faye Nareena in 2021 were praised for their quality, offering a glimpse of the potential. The dream felt tangible, and capital flooded in, eager to back the next big thing.

The Great Unraveling: Diagnosing the Failure

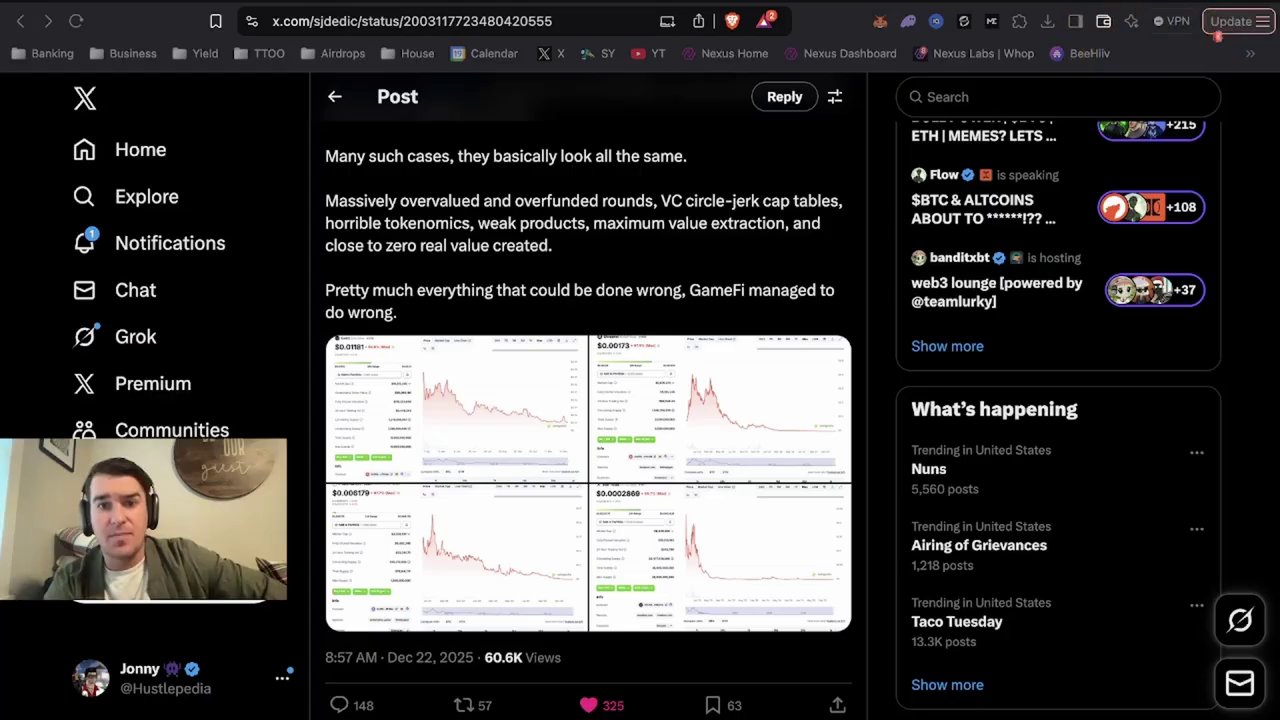

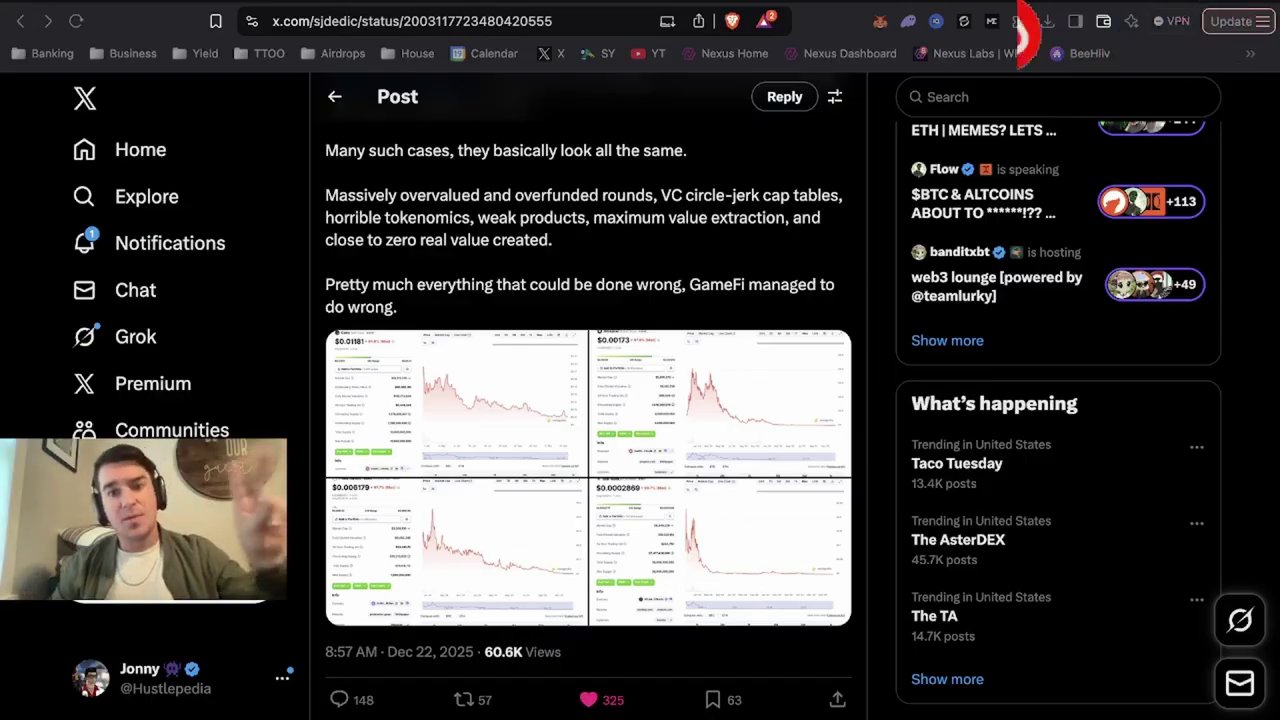

Fast forward to the present, and the scene is starkly different. The GameFi vertical has become one of the worst-performing in crypto. The data tells a painful story: blockchain gaming activity dropped 17% quarter-over-quarter, over 300 gaming products went inactive in a single quarter, and investments have plummeted by 93% year-over-year. The VC interest that once fueled the boom has “basically vanished.”

So, what caused this spectacular collapse? The analysis points to several core, interconnected failures:

- Massively Overvalued and Overfunded Projects: Venture capital flooded the space, creating bloated valuations disconnected from reality. Projects like Gunzilla raised over $82 million only to see their Fully Diluted Valuation (FDV) drop 90%. Shrapnel collapsed 99% after a $57 million raise. Pirate Nation shut down entirely after raising $33 million. This created VC cap tables designed for extraction, not ecosystem building.

- Horrendous, Extractive Tokenomics: This is cited as the industry’s “big fault.” Token models were engineered to benefit insiders and VCs, with massive unlocks and inflationary mechanics that left retail investors holding the bag. The tokens were often poorly integrated, serving more as fundraising tools than functional game elements.

- Weak Products and Questionable Teams: Many projects were built by teams with overstated credentials. Claiming past employment at giants like Activision or Ubisoft often meant minimal, non-leadership roles. The focus was on the fundraise, not on the grueling work of building a fun, polished game. As one critic noted, projects optimized for rewarding “locust swarms” of mercenary players rather than creating experiences people genuinely wanted to play.

- Maximum Value Extraction, Minimum Value Creation: A toxic pattern emerged: raise money, hype the token, and then essentially quit. Teams lacked the incentive or ability to build a quality game, leading to a landscape littered with abandoned projects and “close to zero real value created.”

A Glimmer of Hope: The Exceptions to the Rule

Despite the bleak landscape, there are rare bright spots proving that success is possible with the right model. These exceptions provide a blueprint for what could work.

The recent launch of FableBorn’s Power Protocol token is a standout. Unlike most gaming tokens that crash on launch, it achieved a 300% gain post-TGE (Token Generation Event). This success is attributed to a stronger product foundation and more thoughtful token integration.

Other projects showing promise include:

– Galaxia Planet X: Described as “Call of Duty Mobile meets Web3,” it champions an ownership model “for the players, by the players,” focusing on asset ownership over speculative tokenomics.

– Providence: Having raised $16 million, this project is highlighted for having a team with real experience and, crucially, a game that is reportedly “incredibly fun.”

These examples underscore a critical shift: the focus is moving from speculative token plays to genuine gameplay and asset ownership. This aligns with the broader evolution we’re seeing in how users interact with blockchain technology, moving beyond pure speculation to tangible utility, similar to the social token dynamics explored in platforms like Zora.

The Radical Prescription: Do Games Even Need Tokens?

After years of observation and disappointment, a provocative thesis has emerged from within the crypto gaming community: in-game economies don’t need a native token at all.

The argument is compelling. Look at the traditional gaming titans: Fortnite, CS:GO, Call of Duty. They generate billions annually from microtransactions—players buying skins, camos, and emotes. The currency used (V-Bucks, Cod Points) is a closed-loop, dollar-pegged system. It’s not a tradable crypto token; it’s a payment rail. The real value and secondary market activity are in the assets themselves.

The proposed model for a successful Web3 game is strikingly simple:

1. Create a genuinely good, fun game. Players will abandon a bad game regardless of its earning potential.

2. Create scarce, desirable in-game assets (skins, weapons, land).

3. Let players truly own these assets as NFTs on a blockchain.

4. Facilitate peer-to-peer trading of these assets on a built-in marketplace.

In this model, the project’s revenue comes from initial asset sales and a small transaction fee on secondary market trades—mirroring the immensely profitable Steam Community Market. The blockchain serves as the trustless, transparent ledger for ownership and provenance. The “play-to-earn” model transforms into “play-and-trade,” where value is derived from the cultural cachet and rarity of digital items, not from farming and dumping a inflationary token.

This eliminates the fatal flaws of the past:

– No more Ponzinomics: The economy isn’t propped up by new token buyers.

– VCs can’t dump a token: Their investment is tied to the success of the game’s ecosystem and its marketplace volume.

– Incentives align: The team only wins if they build a game people keep playing and trading in.

This shift in focus—from speculative finance to genuine digital ownership—is part of a larger maturation in crypto, where sustainable models are beginning to emerge from the rubble of hype cycles, much like the search for passive crypto income during quieter market periods.

Conclusion: An Industry at a Crossroads

As we approach 2026, crypto gaming stands at a critical juncture. The first four years as a “main narrative” have been defined more by catastrophic failure than lasting success. The core issues are now painfully clear: extractive funding, broken tokenomics, and a fundamental neglect of game quality.

The path to redemption is narrow but visible. It requires a back-to-basics approach: prioritize the game over the gain. The future likely belongs not to games with complex token ecosystems, but to fun, engaging experiences where blockchain seamlessly enables true digital ownership and player-driven commerce. The bright spots like FableBorn and the philosophy behind Galaxia show that a better way is possible.

The playbook of 2021 is broken. For crypto gaming to have a future beyond 2026, it must adapt. It must learn that you can’t tokenize fun, but you can use tokens—or better yet, tokenized assets—to enhance and empower a community built around a game worth playing. The question for developers and investors is no longer “How do we launch a token?” but “How do we build a world players never want to leave?” For players looking for fun today, the landscape remains challenging, but guides exist for finding legitimate ways to earn crypto by playing free games while the industry resets.

The industry’s survival depends on this fundamental reset. The era of easy money is over. The hard work of building real value has just begun.