The financial landscape is poised for a significant shift as signals point toward a potential return of quantitative easing (QE) by the Federal Reserve. This analysis breaks down the critical data from the Fed’s balance sheet, examines a surprising policy move from the White House, and explores what these developments could mean for risk assets, the housing market, and the crypto sector in the coming year.

Decoding the Federal Reserve’s Critical Crossroads

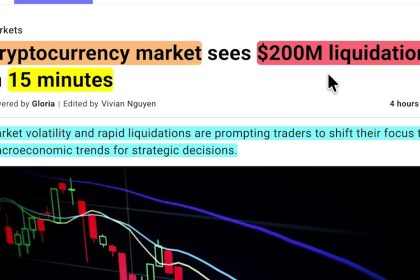

The central narrative for 2026 hinges on the Federal Reserve’s next steps. Analysis of the Fed’s credit and liquidity programs reveals a fascinating trend on its balance sheet. Looking back to 2014-15, we saw a slow accumulation of assets, followed by the dramatic liquidity injections during the pandemic. The current data suggests we may be on the cusp of a new expansion phase.

The key signal to watch is the potential for balance sheet expansion in early 2026. If this trend accelerates, it could be the QE signal the market has been anticipating, where liquidity begins pouring back into financial systems. This environment is traditionally fertile ground for risk assets.

Simultaneously, the Fed is grappling with a complex domestic picture. Recent job numbers show stabilization at their lowest level since March 2021, which is generally positive. However, a critical dilemma is emerging: the labor market appears to be decoupling from economic growth. While growth remains solid, job creation is not keeping pace. This creates a significant policy challenge for the Fed, which is torn between its dual mandate of controlling inflation and maximizing employment.

Market probabilities, as tracked on platforms like Polymarket, heavily favor the Fed holding rates steady in its upcoming January meeting. The greater uncertainty lies in the strategic direction. Will the Fed signal one to two cuts for 2026? More importantly, will it provide a clear, strategic view on whether it believes the economy is on the verge of significant productivity improvements that allow for non-inflationary growth, or will it remain strictly data-dependent and internally divided? Some analysts fear strategic clarity may not arrive until a new Fed Chair is appointed.

White House Policy and a Housing Market at a Breaking Point

Amidst the Fed’s deliberations, a major policy bombshell has dropped from the White House. The Trump administration has announced a ban on large institutional investors from buying single-family homes. This is a direct response to a growing crisis where major investment firms have been absorbing a significant portion of housing inventory, driving up prices and pushing homeownership out of reach for many families.

This move could be a game-changer. The US housing market has reached its most unaffordable level in history. If the ban is effectively executed, it could open the market for more individual buyers. This potential shift coincides with the expectation of interest rates coming down later this year. A combination of lower rates and freed-up inventory could spark a new acquisition boom and a wave of refinancing, especially for the many homeowners currently locked into mortgages at 6-7% or higher. Seeing a mortgage rate with a “5” in front of it could be a major catalyst for activity.

Crypto and Digital Assets: Institutional Validation and New Favorites

The digital asset space continues to mature and attract serious institutional interest. Major traditional finance players are deepening their involvement, validating the asset class for a broader investor base.

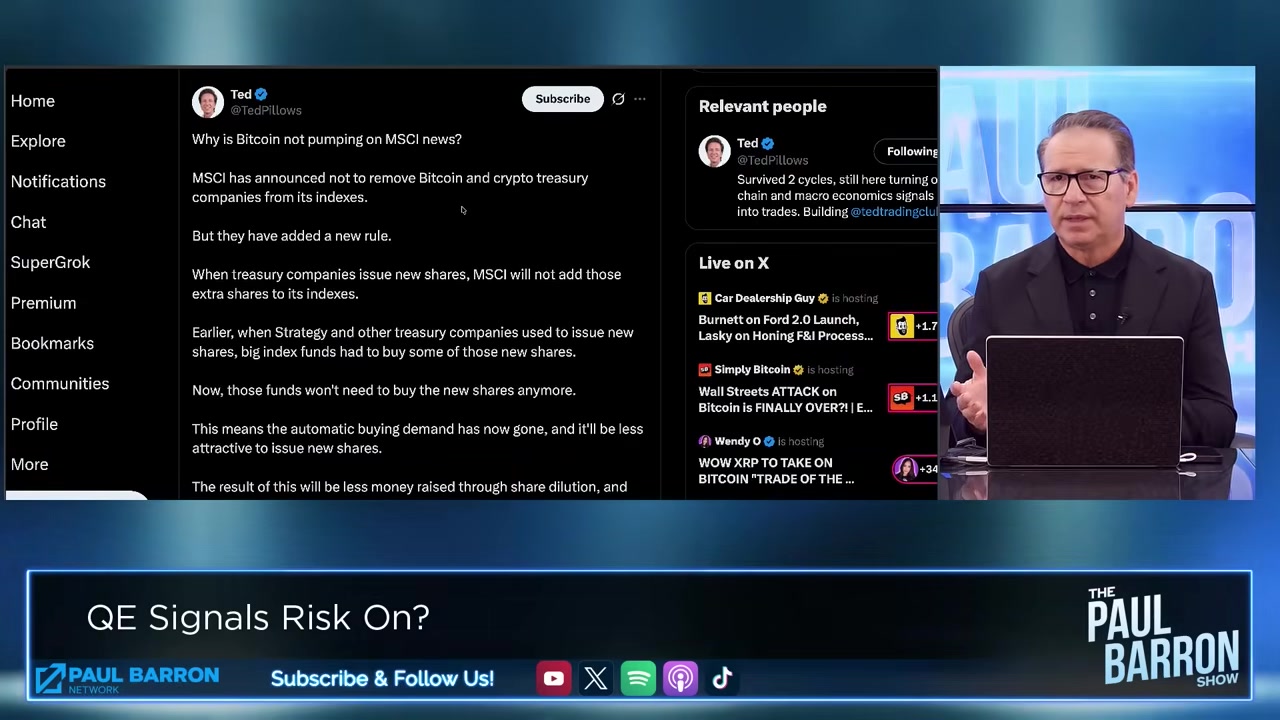

Morgan Stanley’s move to launch a spot ETF is a significant development, following its earlier ETF launches. This provides their vast client network with direct exposure and underscores growing acceptance. In another vote of confidence, MSCI announced it will not remove Bitcoin and crypto treasury companies from its indexes, countering earlier pressure from some traditional banks and providing relief for companies like MicroStrategy.

Within the crypto ecosystem, a fascinating narrative is developing around XRP and Solana potentially becoming the new institutional darlings. Analysis of Q4 flows showed investors piling into XRP ETFs even as prices dipped, suggesting it’s being viewed as a “less crowded trade” compared to Bitcoin or Ethereum. The potential for Ripple to eventually go public continues to generate buzz, though the company has stated no IPO plans for 2026, focusing instead on building market infrastructure and securing global licenses.

Solana, however, is generating substantial momentum based on utility. It has become the largest blockchain by market capitalization for tokenized stocks and recorded $1.4 billion in network revenue in 2025. Its technical advantage—speed and efficiency for tokenizing assets like money market funds—is translating into real-world use cases and growth. With a surging stablecoin supply on its network, many analysts believe Solana’s price performance is lagging its fundamental growth and is due for a significant breakout.

Geopolitical and Regulatory Wild Cards

Beyond monetary policy and market trends, several external factors could sway the economic trajectory.

The ongoing tariff decision from the Supreme Court is a key event. Current market prediction data suggests a low chance that the existing tariffs will hold. If overturned, the market reaction is uncertain but could provide a net positive by reducing trade friction. The White House has already shown signs of softening its position, which may feed into a broader narrative of de-escalation.

On the regulatory front, the long-awaited crypto market structure bill faces another critical juncture with a potential markup next week. The perennial issue is political delay; lawmakers often make last-minute demands that slow the process, risking entanglement with other deadlines like government funding. While a vote in January seems uncertain, progress is being closely watched by the entire digital asset industry.

Internationally, China’s financial maneuvering presents a curious contrast. The move to pay interest on its digital yuan (a centrally controlled digital currency, not a true stablecoin) is seen by some, like Coinbase’s Brian Armstrong, as a competitive jab. It highlights the global race in digital currency development, even as the US continues to debate regulations for private, asset-backed stablecoins.

Strategic Takeaways for the Year Ahead

As we synthesize these signals, a coherent picture for 2026 begins to form, centered on liquidity, policy intervention, and technological adoption.

- Prepare for Liquidity: The charts don’t lie. The Fed’s balance sheet is showing early signs of an upward trajectory. If this evolves into full-blown QE by early 2026, liquidity will be the dominant market theme. In such an environment, risk assets—including stocks and cryptocurrencies—historically perform well.

- Watch the Housing Reset: The ban on institutional buyers in single-family homes is a bold experiment. Its success could cool a red-hot market and create opportunities for individual buyers and builders, especially if paired with lower mortgage rates. This is a sector in transition.

- Diversify within Crypto: Bitcoin and Ethereum remain pillars, but institutional and savvy retail flow is searching for the next wave of growth. Solana’s fundamental metrics and XRP’s positioning as an institutional alternative make them strong candidates for outperformance, particularly in a liquidity-rich environment.

- Expect Volatility from Policy: The Fed’s internal divisions, the Supreme Court’s tariff ruling, and the fits-and-starts of crypto legislation guarantee that 2026 will not be a smooth ride. Strategic patience and a focus on long-term trends—like digital asset adoption and productivity gains—will be essential.

The interplay between a potentially stimulative Fed, targeted government policy, and the relentless innovation in digital assets sets the stage for a dynamic and potentially lucrative year. While the path will be marked by uncertainty and debate, the underlying currents are pointing toward a renewed embrace of risk and a reconfiguration of traditional markets. For investors and observers, the message is clear: pay close attention to the Fed’s balance sheet, the execution of new housing rules, and the on-chain data telling the real story in crypto.