After years of dormancy, the crypto gaming and sports sector is showing unmistakable signs of life in 2026. While privacy coins have dominated recent trends, a new wave of momentum is building around projects with real-world utility and clearer roadmaps. This isn’t just a fleeting meme pump; it’s a resurgence marked by triple-digit gains, fundamental improvements, and major real-world catalysts that could define a significant subtrend for the year. From OG infrastructure plays to fan-powered sports ecosystems, let’s dive into four of the hottest tokens waking up the market and analyze whether this momentum has staying power.

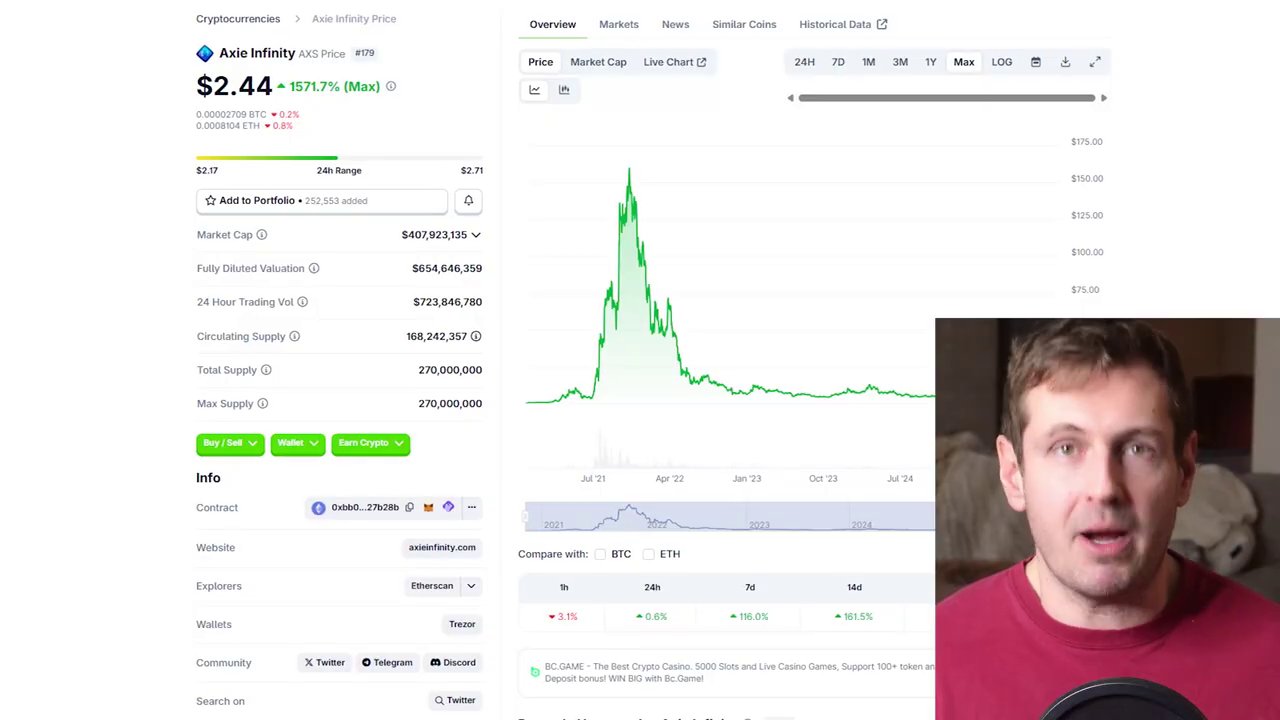

Axie Infinity (AXS): The OG’s Loud Wake-Up Call

Leading the charge with the most dramatic recent performance is Axie Infinity (AXS). Trading around $2, the token saw a staggering 178% pump over a 30-day period, a move that has forcefully pulled attention back to a project many had written off. For years, the broader GameFi market appeared flat and uninspired, but Axie’s aggressive reprice suggests a fundamental shift.

Crucially, this surge doesn’t feel like random speculation. Research indicates it’s largely driven by the project finally tackling the systemic issues that crippled it and others like GameFi in the last cycle. The team has made significant changes to SLP emissions, which has massively reduced token inflation. This means fewer tokens are constantly hitting the market, alleviating the non-stop sell pressure from bot farming that plagued the ecosystem.

Coupled with these improved tokenomics is a renewed excitement around Axie’s 2026 roadmap. Key focuses include moving in an MMO (Massively Multiplayer Online) direction, upgrades to the Ronin sidechain, and governance changes. When a project combines tangible economic fixes with a clear “next chapter” narrative, it creates a powerful recipe for capital rotation. This is especially potent when the entire sector begins to heat up.

So, will AXS keep pumping? The potential is there, but it hinges entirely on follow-through. If Axie continues to deliver on its roadmap and the reduced sell pressure holds, this move could solidify into a sustained trend. However, failure to execute could lead to sharp pullbacks. For those interested in the evolving landscape of play-to-earn, our analysis in The 2025 Crypto Gaming Awards: Winners, Shutdowns, and What to Expect in 2026 provides crucial context on the industry’s recent trials and transformations.

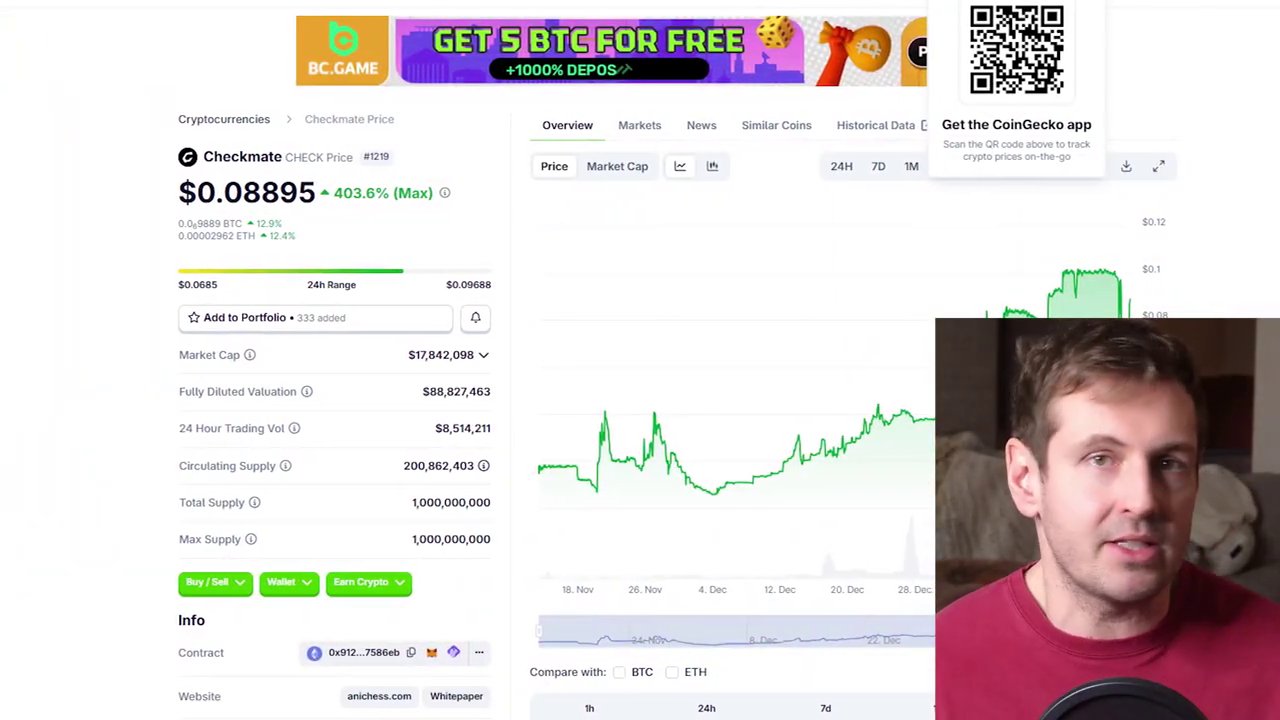

Checkmate (CHECK): Volatility and Hype in a Skill-Based Arena

Making its debut on many radars is Checkmate, with the ticker CHECK. This token has been “absolutely flying,” posting gains of roughly 152% over a recent 30-day snapshot. Trading at just a few pennies, such explosive moves instantly magnetize attention, and in Checkmate’s case, the pump is attributed to three main factors.

- Exchange Exposure: New or higher-profile listings have brought in fresh liquidity and an entirely new audience that previously may not have had access to the token.

- Token Events: Strategic moves like token burns and the loading of rewards, paired with strong community messaging, have created a setup where holding and participating feels more attractive than immediate selling.

- A Simple, Relatable Story: At its core, Checkmate is a competitive skill-based game with rewards and an esports angle. This is a narrative that people grasp immediately, especially when compared to more complex DeFi mechanisms.

Where does Checkmate go from here? More pumps are certainly possible, but this is a high-volatility token. The critical factor to watch is whether the current hype can convert into sustained user growth and genuine gameplay activity. If the project can build a durable ecosystem around its competitive premise, it could stay hot. If not, traders should be prepared for significant swings in both directions. For gamers looking to explore legitimate earning opportunities, our guide on Level Up Your Fun: 8 Real Ways to Earn Crypto by Playing Free Games offers a great starting point beyond speculative trading.

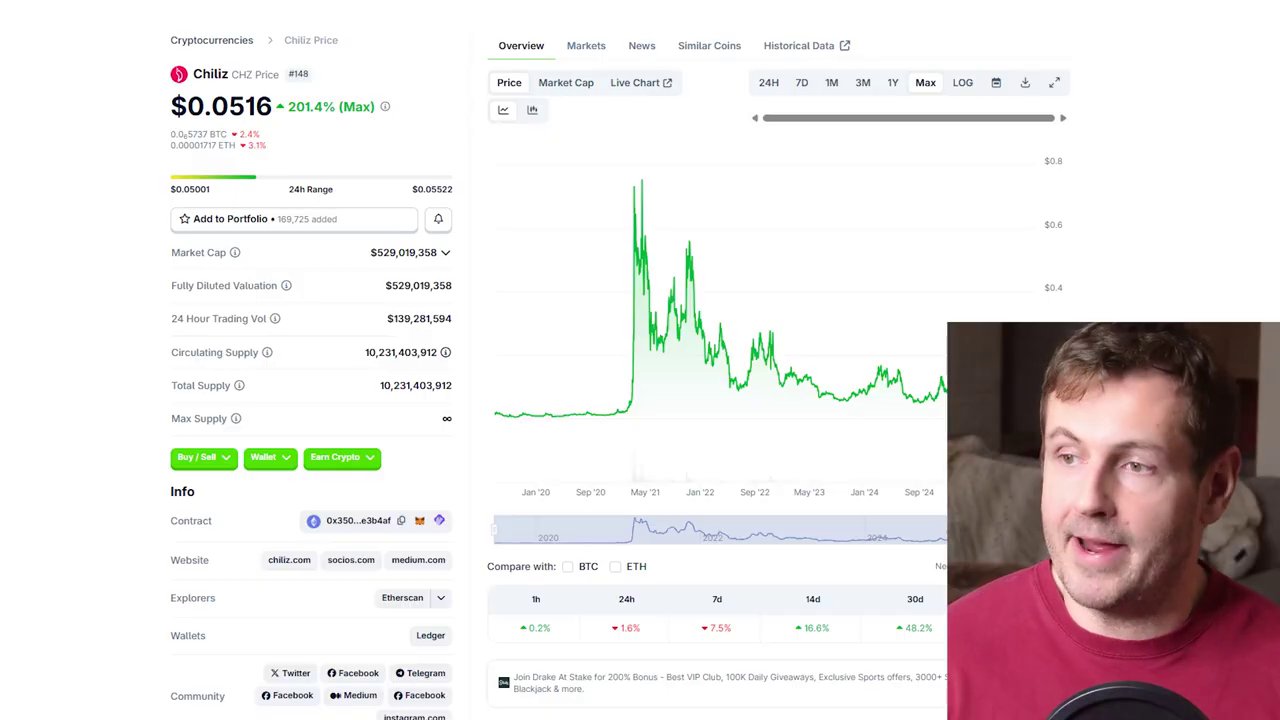

Chiliz (CHZ): Positioning for a Sports-Fueled 2026

Quietly building formidable momentum is Chiliz (CHZ), the backbone of the fan token ecosystem. Currently around $0.50, CHZ posted a more modest but significant 41% gain over 30 days, climbing back into the top 100 cryptocurrencies by market cap (over $500 million). For a large, established token, this kind of move often signals strategic positioning rather than mere hype.

Chiliz possesses one of the clearest narratives in crypto: bridging real sports fans with their favorite teams through blockchain engagement. In 2026, the project is leaning fully into global expansion, with a major near-term catalyst arriving on January 31, 2026. This is when the Chiliz CEO is set to unveil “Chiliz 2030,” a new roadmap reveal. Markets historically respond well to such events, especially when they are tied to concrete, real-world expansion plans.

The excitement is doubly fueled by upcoming global events. Chiliz is deeply integrated into soccer (football) with the World Cup on the horizon, but it has also moved aggressively into Formula One. Major F1 teams are using fan tokens powered by CHZ, allowing supporters to vote on team decisions, unlock VIP perks, and earn rewards. Talks of expanding utility or launching new F1 initiatives provide a powerful narrative that could continue to benefit the CHZ price.

Should CHZ stay on your radar? The answer is a definitive yes. The January 31st roadmap reveal will be pivotal. If it outlines clear expansion plans with stronger utility, the token has room to climb. A disappointing reveal, however, could trigger a short-term cooldown or sell-off. Regardless, Chiliz is objectively a token that is garnering serious attention again as the world’s biggest sporting events approach.

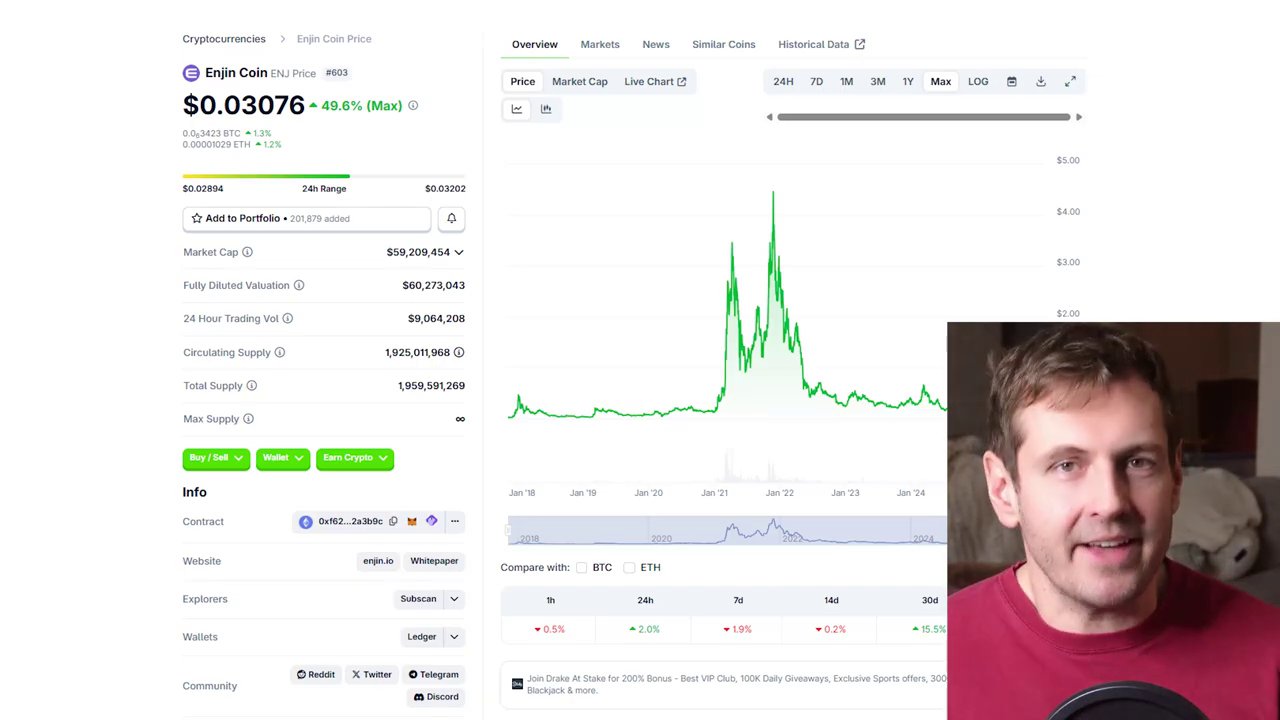

Enjin (ENJ): The Infrastructure Bet on a Healthier GameFi Future

Rounding out the list is the original gaming infrastructure play, Enjin (ENJ). The ENJ token, trading around three cents, saw an 11% increase over 30 days—the most modest move on this list but potentially the most telling. Enjin doesn’t typically pump on the success of a single game; it moves when the market believes Web3 gaming as a whole is entering a healthier, more sustainable phase.

Instead of betting on one game variable, Enjin focuses on the underlying infrastructure: the tools, wallets, and systems that multiple games and projects can build upon. In 2026, this narrative is critical. If the GameFi sector is genuinely shifting towards sustainability—characterized by lower token emissions, real utility, and better player experiences—then foundational infrastructure tokens like ENJ naturally come back into focus.

What’s the outlook for ENJ? Its fate is tied to the broader gaming narrative. If the sector’s revival manages to stay alive and gain depth across the market, ENJ stands to benefit significantly from that rotation as developers seek robust tools. It’s a bet on the ecosystem’s foundation rather than any single house built upon it. This strategic, long-view approach to crypto gaming is part of a larger trend we’ve been tracking, as discussed in our recent overview of Crypto Gaming’s Surprising Comeback: Airdrops, Privacy, and Major Players Return.

Conclusion: A Trend Worth Watching

The reawakening of gaming and sports tokens in early 2026 presents a compelling shift from the speculative frenzy of past cycles. The pumps we’re seeing in projects like Axie Infinity (AXS) and Checkmate (CHECK) are increasingly tied to fundamental improvements in tokenomics, clear roadmaps, and real-world utility, as seen with Chiliz (CHZ) and its sports partnerships. Meanwhile, Enjin (ENJ) offers a way to bet on the health of the entire sector’s infrastructure.

This doesn’t guarantee a smooth ride upward—volatility remains high, and each project’s success depends on executing its stated plans. However, the combination of reduced inflation, strategic positioning for major global events, and a focus on sustainable infrastructure suggests this could be more than a fleeting trend. For investors and enthusiasts, these four tokens provide a focused lens through which to watch the evolving story of crypto gaming and sports in 2026. As always, thorough research and an understanding of the underlying narratives will be key to navigating this exciting and resurgent space.