Welcome back to our market analysis. Today, we’re unpacking a complex web of factors influencing the current financial landscape, from geopolitical tensions and tariff announcements to their ripple effects on cryptocurrency markets. We’ll explore the reasons behind recent market movements, assess potential future scenarios, and highlight specific assets that warrant your attention in these turbulent times.

Understanding the Core Catalysts: Tariffs and Tensions

The primary driver of recent uncertainty stems from the announcement of new tariffs. The discussion points to significant actions, particularly concerning Greenland and broader international trade policies. The imposition of these tariffs is not an isolated event; it’s a strategic move with calculated risks and potential repercussions.

The geopolitical dimension cannot be overstated. There is a heightened chance of conflict, with specific mentions of tensions involving Iran. The interplay between these geopolitical risks and economic policy creates a volatile foundation for global markets. When major powers engage in trade wars or saber-rattling, the traditional markets often react with fear, which can paradoxically create opportunities in alternative asset classes like cryptocurrency. For those looking to build a portfolio resilient to such traditional market shocks, exploring free and safe ways to earn crypto can be a prudent first step, as detailed in our guide 8 Free and Safe Ways to Earn Crypto by Playing Games (No Investment Needed).

Market Reaction and Technical Analysis

So, where is the market headed? The key question is whether it will move up or down. The analysis suggests looking closely at the technical indicators and price action around these tariff announcements. Previous support and resistance levels become critical. The market had reached a point where a breakdown was anticipated, and the new tariffs acted as the catalyst.

The technical perspective reveals a crucial juncture. If the market breaks below a certain key level, the next target becomes clear. The analysis references specific tools and chart patterns—like certain moving averages and trend lines—that are being tested. The 97,000 level is mentioned as a significant benchmark that was previously touched, indicating a zone of major interest for traders. The overarching message is one of caution: without a clear positive catalyst or resolution to geopolitical tensions, the market may continue to face downward pressure or enter a consolidation phase.

Spotlight on Cryptocurrency Opportunities

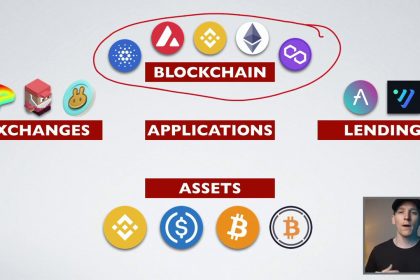

Amidst the traditional market turmoil, the analysis shifts focus to specific cryptocurrencies that may present opportunities. This is where the conversation gets particularly interesting for digital asset investors.

First, Bitcoin (BTC) is discussed. There’s mention of a potential bounce-back scenario, alongside the possibility of further testing. The inherent volatility of Bitcoin means it can react sharply to both macroeconomic news and its own internal market cycles.

Next, attention turns to ICB Coin. This asset has reportedly seen significant movement and is described as having substantial volume and activity on its base network. The high volatility presents both risk and opportunity, requiring careful analysis before any entry.

The discussion also covers Silver as an asset class, noting its price action in relation to the US dollar. The analyst references a personal projection, suggesting a watchful eye on the $100 level for silver, indicating it as a potential area of technical importance.

Strategic Takeaways and Final Thoughts

In conclusion, we are operating in a market defined by external shocks. The imposition of new tariffs and persistent geopolitical risks, especially concerning Iran, are creating waves across all financial markets. For the savvy investor, this environment demands a dual strategy: defensive positioning in traditional assets coupled with a keen eye on opportunistic plays in the crypto space.

The technical analysis provided underscores the importance of key levels. Whether it’s the 97,000 benchmark for a major index or the $100 level for silver, these are the zones that will dictate the next major move. In cryptocurrencies, coins like ICB Coin show that even in a shaky macro environment, specific assets can exhibit independent momentum based on their own ecosystem developments and trading volume.

For those interested in the practical application of crypto in dynamic sectors, the growth of play-to-earn gaming continues to be a fascinating intersection of technology and finance. Understanding these models can provide another lens through which to view crypto utility, as explored in our article on The Top 5 Freshest Play-to-Earn Games You Need on Your Watchlist.

The final takeaway is clear: Stay informed, watch the key levels mentioned, and understand that today’s market movements are a direct reflection of global policy decisions. Volatility is not just noise; it’s the market digesting new information. Your job is to interpret that digestion and position yourself accordingly, whether you’re trading traditional markets or exploring the frontiers of cryptocurrency. Remember, in times of uncertainty, knowledge and a clear strategy are your most valuable assets.