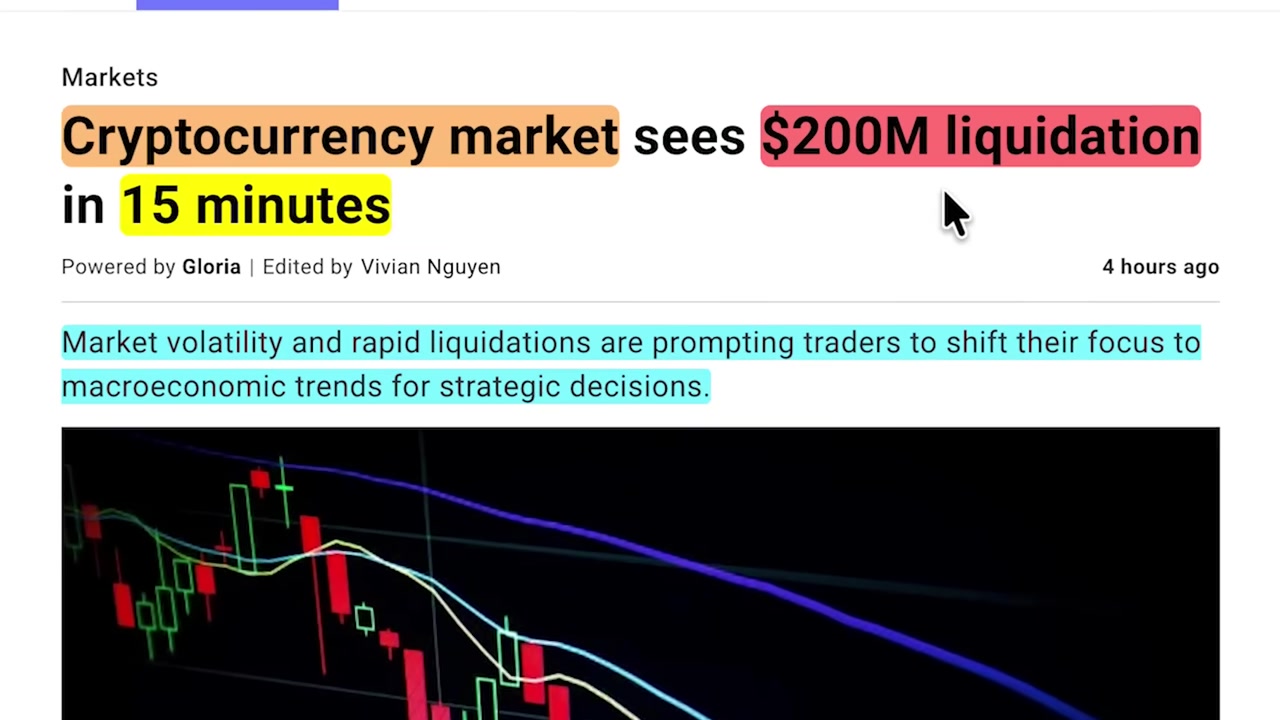

The cryptocurrency market experienced a violent shakeout today, with over $200 million in positions liquidated in just 15 minutes. This sudden downturn was triggered by renewed global trade tensions and unexpected political announcements, sending shockwaves through digital asset prices. However, zooming out reveals a familiar pattern, and for seasoned investors, this volatility may represent a strategic buying opportunity rather than a reason for panic.

The Immediate Catalyst: Politics and Policy Collide

The immediate trigger for today’s market sell-off stems from the geopolitical arena. Former President Donald Trump announced a proposal for massive tariff increases on Chinese imports, specifically targeting rare earth exports. This unexpected move reignited fears of a full-blown global trade war, causing risk assets across the board to tumble. The cryptocurrency market, still perceived by many traditional investors as a high-risk asset class, was not spared.

Simultaneously, the effects of a potential U.S. government shutdown began to materialize, with substantial federal layoffs starting as Congress remains deadlocked over funding. This political gridlock adds another layer of macroeconomic uncertainty, contributing to the risk-off sentiment. However, some analysts view this political pressure as a potential catalyst for monetary policy change. The argument is that such economic strain makes it “much more likely” for the Federal Reserve to cut interest rates sooner rather than later to stimulate the economy.

A Bullish Perspective: History Doesn’t Lie, It Rhymes

Despite the alarming headlines, a deeper analysis of market structure offers a more reassuring picture. From a technical chart perspective, the current pullback looks similar to healthy retests and consolidation phases seen in previous Bitcoin cycles. The fundamental argument is that market structure is not broken. This dip is being framed not as a breakdown, but as a necessary and “appropriate retest” of key support levels before the next leg up.

For investors who lived through the brutal crypto winter of 2018, when Bitcoin crashed to $6,000 and later capitulated to $3,200, today’s volatility feels different. The infrastructure, institutional adoption, and regulatory clarity are in a completely different, more mature place. The sentiment from experienced market participants is clear: “I’ve never been more confident on Bitcoin, Ethereum, Solana, quality cryptos than today.” This confidence is being backed by action, with many stating they are not just holding but actively buying more during this dip.

The Underlying Bull Case: Adoption Accelerates Beneath the Surface

Beneath the short-term price action, powerful fundamental trends continue to build. Major financial institutions are not retreating; they are charging forward. Morgan Stanley has removed restrictions on Bitcoin and crypto investments for all its clients, effectively opening the floodgates for a new wave of institutional capital. Meanwhile, banking giant BNY Mellon is taking concrete steps toward tokenized deposits and blockchain-based payments, signaling that traditional finance isn’t just buying crypto—it’s starting to use its underlying technology.

Regulatory clarity, long seen as the missing piece for mass adoption, is also progressing. The Market Structure Clarity Act is advancing through Congress with bipartisan support. This legislation aims to resolve the outstanding issues from the last administration by clearly defining which digital assets are commodities and which are securities, directly countering the regulatory uncertainty that has plagued the industry. As one CEO stated, “This freight train has left the station,” indicating strong momentum toward sensible crypto law.

Perhaps the most profound bullish signal comes from the humanitarian and geopolitical sphere. The 2025 Nobel Peace Prize winner publicly endorsed Bitcoin, describing it as a tool that has “evolved from a humanitarian tool to a vital means of resistance.” She spoke of envisioning Bitcoin as part of her nation’s reserves to help rebuild. This underscores a powerful, non-speculative use case: Bitcoin as a lifeline for people under authoritarian regimes or with collapsing fiat currencies. As highlighted by the Bitcoin Policy Institute, for the 87% of the global population living under such conditions, “It’s not about making profit. It’s about survival.” This real-world utility forms an incredibly strong foundation for long-term value.

Navigating the Dip: Strategy and Sentiment

So, how should an investor process today’s red markets? The key is to differentiate between a broken thesis and a temporary discount. On-chain data reveals interesting activity: while some long-term holders are selling, there is “real money lurking beneath the surface” strategically buying at these lower prices, dollar-cost averaging at every dip. This is the behavior of confident, long-term investors, not panicked speculators.

The focus should remain on quality assets like Bitcoin, Ethereum, and Solana. Ethereum, for instance, dipped hard but remains trading within a defined range. A breakout from this range could be “really bullish,” and today’s move is seen as a “very healthy” retest. The overarching question for every investor is: Has something fundamentally changed to break the crypto thesis, or is this a temporary pullback within a larger bullish trend?

For those interested in the broader ecosystem of earning crypto, this period of lower prices can be an excellent time to explore other avenues like Play-to-Earn games, which allow you to accumulate assets regardless of market sentiment. Furthermore, the concept of monetizing your own data, as teased in the clip from Killer Whales, hints at the next frontier of Web3—turning your digital activity into an income stream, a theme explored in experiments like My Crypto Experiment: A Month-Long Journey Testing Online Tools.

Conclusion: Volatility is the Price of Admission

Today’s market turmoil, driven by political headlines and macroeconomic fears, is a stark reminder of the volatility inherent in the cryptocurrency space. However, for the informed investor, it also serves as a clarifying moment. The core bullish drivers—institutional adoption, regulatory progress, and profound real-world utility—are not only intact but accelerating.

The current dip is viewed by veterans as a “major buying opportunity” within a cycle that has repeatedly rewarded patience. While short-term traders were liquidated, long-term believers are accumulating. The journey is never a straight line up, but as history has shown, the trend for quality crypto assets has been decisively higher. The message from the front lines is clear: keep your mind straight, stay in the game, and recognize market shakeouts for what they often are—not an end, but a chance to build a stronger position for the future upswing.