The cryptocurrency market is living up to its reputation for volatility, with Bitcoin acting like an “erratic little child” and liquidating positions on both sides of the trade. Amidst this turbulence, key signals are emerging: a potential Federal Reserve rate cut, Bitcoin’s official entry into the $2 trillion asset club, and significant on-chain data pointing to real institutional demand. This article unpacks the latest market movements, separates the leveraged “nonsense” from genuine capital inflows, and examines both the bullish catalysts and potential headwinds on the horizon, providing a clear-eyed view of where Bitcoin might be headed next.

The Macro Backdrop: Rate Cuts and a $2 Trillion Reality

The financial world is holding its breath for the next Federal Reserve decision. Current market pricing suggests an 88.4% probability of a rate cut this week. For crypto markets, which have historically been sensitive to liquidity conditions, this could be a significant catalyst. A rate cut is often viewed as the “liquidity event” that injects fresh capital into risk assets, potentially providing a tailwind for Bitcoin and the broader digital asset space.

Adding a powerful layer of perspective is commentary from Tom Lee of Fundstrat. He highlights a monumental milestone: Bitcoin has become a two-trillion-dollar asset. His argument is rooted in financial history: nothing that has ever reached this colossal market capitalization has simply vanished. This isn’t just hype; it’s a statement about Bitcoin’s entrenched position in the global financial system. As Lee puts it, ignoring an asset of this scale is done at one’s own peril. This perspective is crucial for investors feeling shaken by short-term price swings, reminding them of the asset’s long-term resilience and growing institutional adoption.

Decoding the Data: Real Demand vs. Leveraged Nonsense

Beneath the surface volatility, key metrics reveal where smart money might be flowing. One of the most telling indicators right now is the Coinbase Premium Index. This index measures the price difference for Bitcoin on Coinbase Pro (primarily used by U.S. institutional and retail investors) compared to other global exchanges.

When this index is positive and rising—as it currently is—it signals strong buying pressure from U.S.-based entities, often interpreted as “big players” accumulating. An elevated premium suggests real spot market inflows, meaning investors are buying actual Bitcoin to hold, not just engaging in high-risk leveraged derivatives. This is a critical distinction in the current environment.

Because on the other side of the coin, we have what the analyst aptly calls “leveraged nonsense.” The wild price swings have led to massive liquidations. In just the last 24 hours, $442 million worth of positions were wrecked. A particularly sharp move saw Bitcoin dump from $89,000 to $87,000 in a four-hour window, liquidating $171 million in “late longs”—those high-leverage positions that chase a move upward.

The lesson here is stark: Low-leverage, longer-timeframe positions can sustain these violent moves, while high-leverage, short-term bets get wiped out. This is evident in the analyst’s personal portfolio approach. While actively trading, they employ dollar-cost averaging during crashes, leading to significant profits on Bitcoin and Ethereum positions. A Solana trade may currently be at a loss, but the strategy involves patience and risk management, using only capital one can afford to lose. This disciplined approach contrasts sharply with the frantic, leveraged trading causing so much pain in the market.

For traders looking to engage with the market, whether aiming to go long, short, or something in between, having a reliable platform is key. The analyst mentions their partnership with Sendex, which offers trading bonuses for users who sign up via their affiliate link, providing an option for those seeking a new exchange.

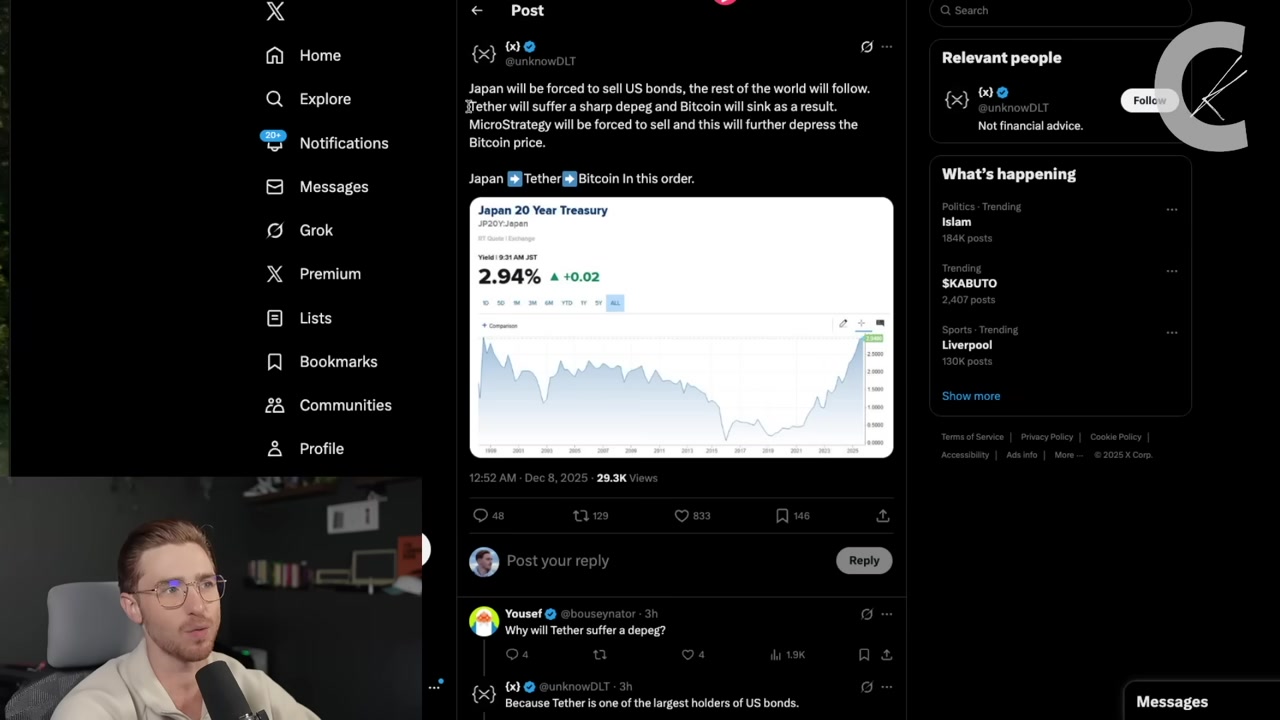

Potential Storm Clouds: Bond Yields and Tether FUD

Not all signals are green. A significant potential headwind is brewing in the global bond market. The Japan 20-year government bond yield has climbed to 2.9%. Rising global yields can make safer, income-generating assets like bonds more attractive relative to volatile assets like Bitcoin, potentially leading to selling pressure.

This ties into a more complex and concerning narrative for crypto: the stability of Tether (USDT). Tether is one of the world’s largest holders of U.S. Treasury bonds. If a sustained sell-off in bonds occurs (driven by factors like rising yields), the value of Tether’s massive reserves could theoretically take a hit, leading to what’s known as a “de-peg”—where USDT loses its 1:1 value with the U.S. dollar.

Why does this matter for Bitcoin? A loss of confidence in the largest stablecoin could trigger a liquidity crisis within crypto markets. If Tether faced a sharp de-peg, it could force panic selling of Bitcoin and other assets, potentially creating a downward spiral. Furthermore, large macro trading strategies that use Bitcoin might be forced to sell in such a scenario, amplifying the fear, uncertainty, and doubt (FUD). It’s crucial to note this is a risk scenario, not a prediction, but it’s a piece of market structure FUD that informed participants should be aware of.

Technical Outlook: Wedges, Resistance, and Key Levels

From a chart perspective, Bitcoin is at a technical inflection point. The analyst observes a wedge pattern forming on the charts. While they prefer basic support and resistance analysis, the pattern is clear. A decisive break to the upside from this wedge could propel Bitcoin toward the low $100,000 region.

However, this same zone also presents a major test. A move to $100,000 that then fails to break above key moving averages, like the 200-day MA, could ironically serve as the technical confirmation of a bear market that pessimists are looking for. This highlights the delicate balance in the current market: the path to new highs is visible, but so is the potential for a significant rejection. The analyst commits to monitoring this unfolding situation closely, providing updates on both market structure and their personal trade management.

Conclusion: Navigating Uncertainty with Discipline

The current Bitcoin landscape is a tale of powerful opposing forces. On one side, we have historic institutional adoption, signals of real U.S. demand, and a potential macro liquidity boost from rate cuts. On the other, we face extreme volatility fueled by leverage, rising global bond yields, and latent risks in the stablecoin ecosystem.

The key takeaways for navigating this environment are:

– Focus on spot-driven signals like the Coinbase Premium Index to gauge genuine institutional interest.

– Avoid high-leverage positions that are vulnerable to being liquidated in sudden $2,000 swings.

– Employ disciplined strategies like dollar-cost averaging if accumulating, and only risk capital you can afford to lose.

– Stay aware of macro risks, including bond market movements and their indirect impact on crypto liquidity.

– Watch for a decisive technical breakout from the current wedge pattern, which will likely dictate the next major directional move.

Whether you’re a seasoned trader or a long-term holder, understanding these dynamics is essential. The market is separating disciplined capital from speculative “nonsense.” By focusing on real demand, managing risk prudently, and keeping an eye on both the bullish catalysts and bearish warnings, you can better position yourself for whatever Bitcoin’s “erratic” journey brings next. For those interested in the application of disciplined strategy in other areas of crypto, such as finding sustainable yield, exploring a systematic approach to DeFi liquidity pools can be invaluable. And if you’re looking to engage with crypto through more interactive means, the world of play-to-earn games on Solana offers a growing avenue for participation.