Welcome back to the market analysis. The cryptocurrency landscape has just experienced a significant tremor, with Bitcoin leading a sharp downturn after hovering near the $95,000 mark. This sudden crash, visible across major exchanges, wasn’t just a random dip. It appears to be a complex reaction driven by geopolitical tensions, strategic market plays by large entities, and a ripple effect from traditional Asian markets. As European and U.S. markets prepare to open, the question on every investor’s mind is: is this a temporary flash crash or the beginning of a deeper correction? Let’s dissect the catalysts, analyze the critical support levels for Bitcoin and altcoins, and explore what cautious traders should do next.

The Perfect Storm: Geopolitics and Market Mechanics

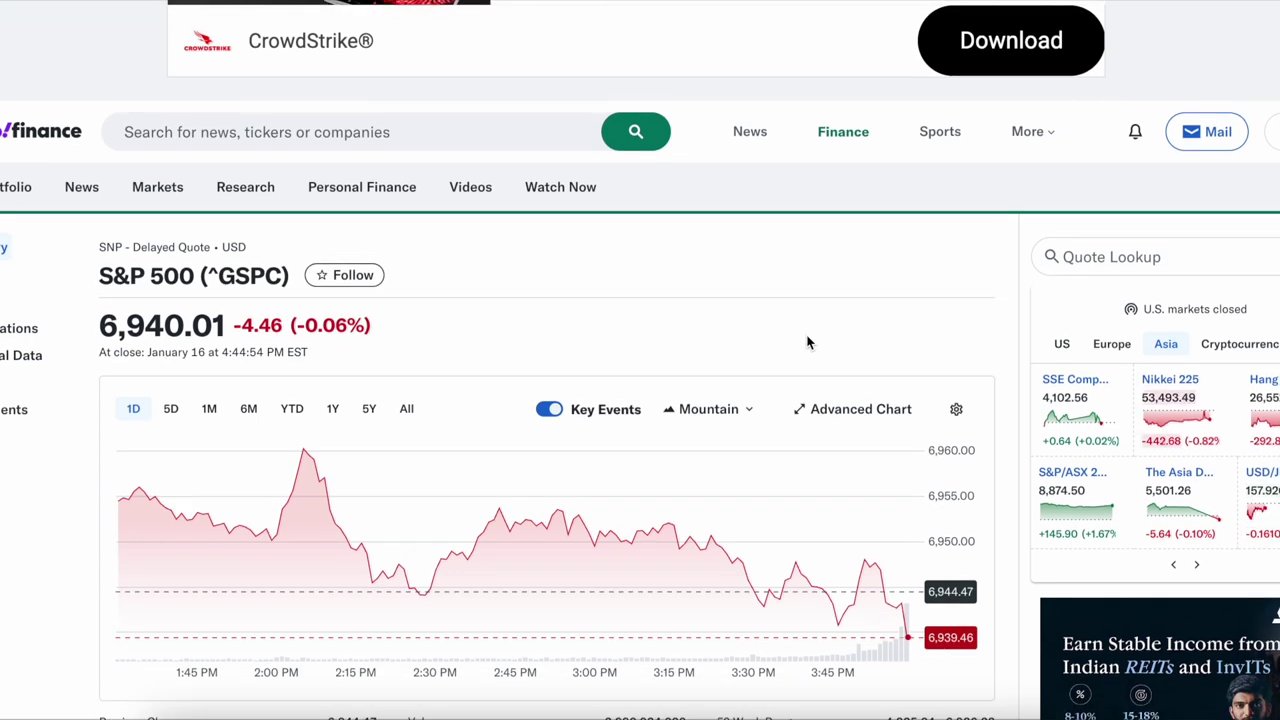

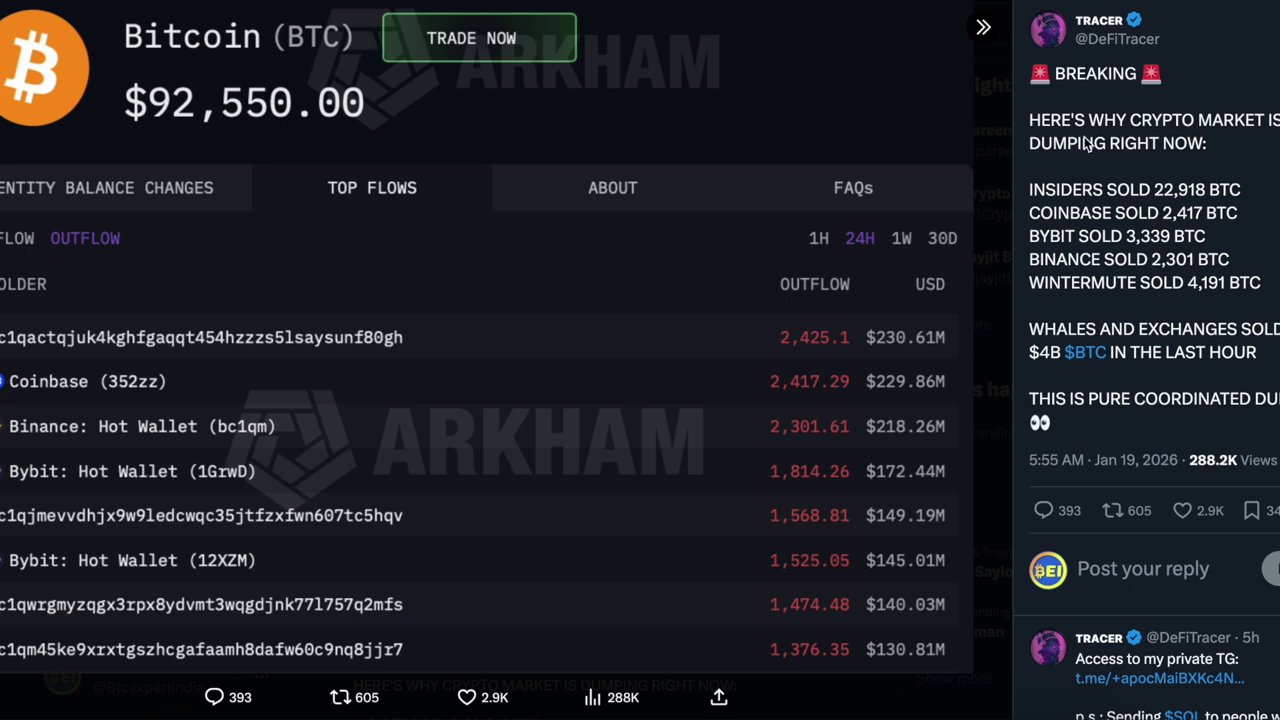

The immediate trigger for the sell-off seems to be a confluence of geopolitical news and aggressive actions by major players, often referred to as “whales” or large exchanges. The analyst points to specific events in Europe creating uncertainty, which has spooked investors. This isn’t just about crypto; a sense of panic was already brewing in Asian equity markets, with indices like Hong Kong’s showing declines of around one percent.

When this kind of global tension emerges, capital often flees to perceived safe havens. Historically, this benefits assets like gold and, increasingly, Bitcoin is seen to follow this pattern over time. However, the initial reaction is typically a risk-off sell-off. Large exchanges and manipulative players (“manu-paterus”) have been accused of exploiting this fearful sentiment, executing massive sell orders that accelerated the downturn into a flash crash. As one resource for navigating volatile markets, understanding these mechanics is crucial, much like knowing the rules in the top Play-to-Earn games you need on your watchlist.

Critical Level Analysis: Where Does Bitcoin Find Support?

Technically, Bitcoin had been using a key level as support after it previously acted as resistance. The breakdown from this zone was a major warning sign. Now, the focus shifts to where Bitcoin might stabilize.

- Immediate Support: The first critical floor is identified around $92,000. A break below this opens the door to the next zone.

- Secondary Support Zone: This lies between $88,000 and $90,000. This area is expected to provide a stronger buying interest.

- Major Support Zone: If selling pressure continues unabated, the next significant area to watch is between $83,000 and $85,000.

The analyst emphasizes that the way large exchanges are currently operating makes the market particularly treacherous for leveraged positions. A single flash crash can liquidate over-leveraged traders before the market even begins to recover, which is why extreme caution is advised with futures trading during such periods.

Altcoins in the Downdraft: SOL, BNB, and XRP

The crash wasn’t isolated to Bitcoin. Major altcoins like Solana (SOL), Binance Coin (BNB), and XRP also saw significant drops, but their charts show defined trading ranges and support levels that savvy investors are watching.

- Solana (SOL): It’s trading within a clear box pattern. It faces rejection near the $150-$155 area but finds support around the $100-$120 zone. These levels are key for potential entry or exit points.

- Binance Coin (BNB): Similarly, BNB has identifiable support and resistance levels. The analysis suggests focusing on it when it approaches its lower support band, around the $350 area, for a potential bounce.

- XRP: For XRP, a critical support level sits at $0.84. The price action shows it attempting to bounce back from this level, making it a focal point for traders looking for a reversal play.

The key takeaway for altcoins is not to panic-buy at the top of a dip. Wait for the market structure to show signs of stability and for coins to approach their proven support levels before considering an entry. This disciplined approach is similar to the strategy needed when testing new online crypto tools; patience and verification are key.

The Road Ahead: U.S. Markets and Strategic Patience

A significant variable is the upcoming opening of the U.S. markets. Due to a public holiday (Martin Luther King Jr. Day), U.S. markets were closed, potentially insulating them from the initial Asian and European sell-off. The real test comes when they reopen.

- Potential for Further Decline: If the geopolitical situation isn’t resolved or de-escalated by then, U.S. markets could open with a gap down, pulling Bitcoin and the broader crypto market even lower.

- The “Greenland” Factor: The analyst briefly mentions “Greenland” as a strategic point in the geopolitical discussion, hinting at its potential role in the broader tensions affecting market sentiment. This underscores how macro events are deeply intertwined with crypto volatility.

- Long-Term vs. Short-Term: For long-term holders (“long-term” often defined in crypto as 1-3 years), such dips can be opportunities to accumulate quality assets at a discount. However, for short-term traders, the advice is clear: avoid high leverage, focus on spot trading, and wait for clear signals.

Financial commentators on networks like CNBC have warned investors to “get ready for a bad market open,” aligning with the cautious outlook presented here. The Fear & Greed Index, a popular crypto sentiment gauge, is likely to shift deeper into “Fear” territory, which historically can precede buying opportunities for the brave.

Conclusion: Navigating Uncertainty with Discipline

Today’s market crash is a stark reminder of cryptocurrency’s volatility and its sensitivity to global events. The primary drivers appear to be a mix of geopolitical anxiety and targeted selling by large entities, compounded by weak openings in Asian markets.

Key takeaways for investors:

– Monitor Key Levels: Watch Bitcoin’s support at $92K, $88K-$90K, and $83K-$85K. For altcoins like SOL, BNB, and XRP, their respective support zones are crucial.

– Embrace Caution: This is not the time for reckless leverage. The risk of a flash crash liquidating positions is high. Consider strategies that don’t involve excessive risk, such as exploring free and safe ways to earn crypto through other means.

– Think in Timeframes: Separate your short-term trading actions from your long-term investment thesis. Panic selling a long-term hold based on a short-term crash is often a mistake.

– Stay Informed: The situation remains fluid, especially with U.S. markets yet to react. Keep a close watch on geopolitical developments and market technicals.

The week ahead may be challenging, but periods of fear often separate disciplined investors from the rest. By focusing on fundamentals, respecting technical levels, and managing risk, you can navigate this downturn and prepare for the market’s eventual recovery.