The cryptocurrency market is at a fascinating crossroads. While headlines scream about a mysterious founder selling his Bitcoin and prices looking “terrible,” a deeper narrative is unfolding. According to seasoned Wall Street veterans, what we’re witnessing isn’t the end of crypto but a critical maturation phase—a “silent IPO” for Bitcoin. This period of consolidation, marked by large holders diversifying and volatility decreasing, is setting the stage for the next major leg up, with Ethereum also poised for a breakout as the future of finance begins to tokenize.

Decoding the “Silent IPO” of Bitcoin

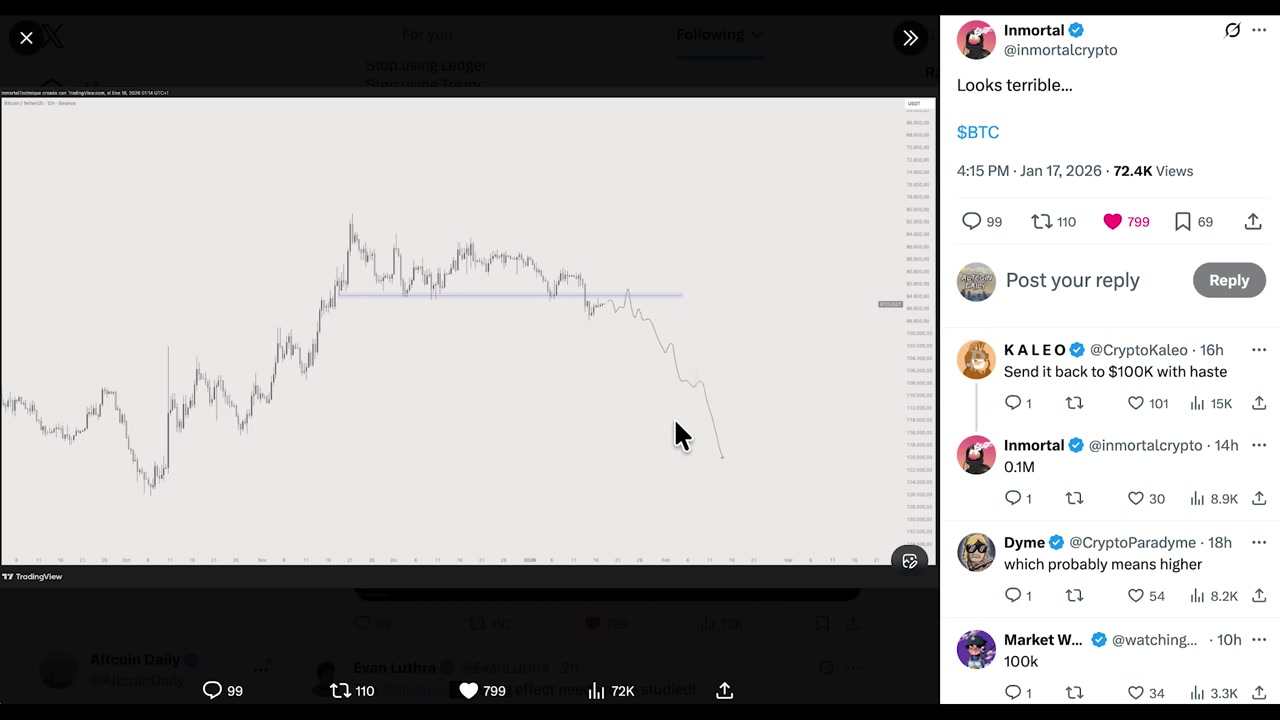

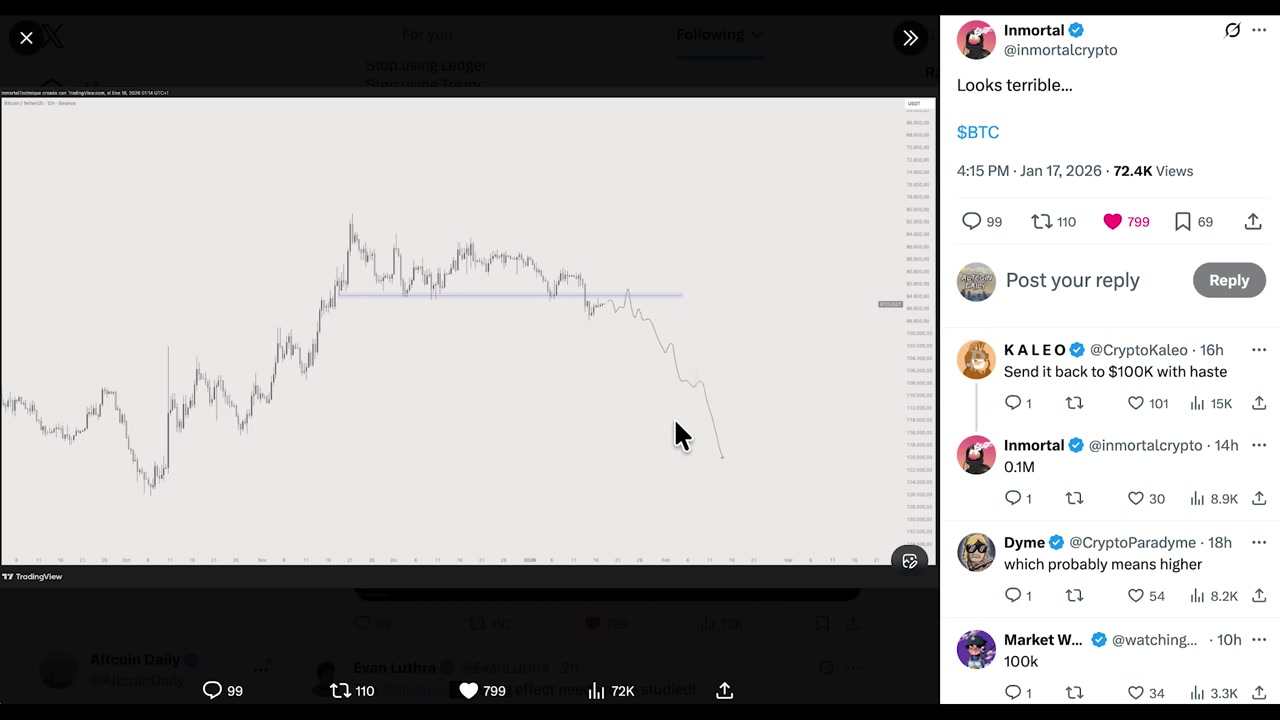

The recent market action has left many investors confused and anxious. The price chart appears weak, and news of long-term holders like the entity known as Satoshi Nakamoto selling significant portions of their stash has fueled fears of an impending bear market. However, framing this through a traditional finance lens reveals a different story.

As explained by a 22-year Wall Street veteran, Bitcoin is undergoing what can be best described as a “silent IPO.” Unlike a traditional company, Bitcoin never had an initial public offering where early investors could cash out. The last several months have effectively served as that price discovery and distribution phase.

“I think what people should think about is, we don’t have an IPO for Bitcoin. But this last four months to me feels like sourcing the pricing of the IPO, where the original investors are getting out of large chunks now.”

This distribution is a natural and healthy process. When an early investor holds a $9 billion position in a single asset, diversification is a prudent financial move. This selling pressure is being absorbed by a broadening base of new investors, including institutions, ETFs, and a growing global user base. It’s a sign of the asset maturing, not breaking.

The Bullish Fundamentals Building Behind the Scenes

Beneath the surface-level price anxiety, every fundamental metric you would want for Bitcoin is strengthening. The narrative that crypto is “dead” ignores the concrete progress being made.

- Institutional and Government Adoption: The financial guardrails are shifting. The U.S. government has reiterated its commitment to exploring Bitcoin as a strategic reserve asset. Major financial institutions are building infrastructure, and regulatory clarity, though slow, is progressing.

- De-risking the Asset: Traditional criticisms of Bitcoin are fading. Its volatility has dropped significantly, with implied and realized volatility falling to 30% and below—levels comparable to many tech stocks. Furthermore, its correlation with traditional risk assets like the NASDAQ is decreasing, enhancing its value as a portfolio diversifier.

- Supply and Demand Dynamics: The upcoming Bitcoin halving in 2024 will cut the new supply entering the market in half. Contrast this with gold, which saw increased mining after its ETF launch. Bitcoin’s hard-capped, predictable scarcity is a unique feature in finance.

Market veteran Tom Lee puts it bluntly: “Bitcoin has become a $2 trillion asset. Never in financial history has anything reached $2 trillion and disappeared.” This scale creates immense inertia and network effects that are nearly impossible to unwind. The asset is moving from a speculative tech experiment to a foundational layer of the new digital economy. For those looking to diversify their crypto exposure beyond just holding assets, exploring avenues like play-to-earn games can be an engaging way to interact with the ecosystem, as detailed in our guide on free and safe ways to earn crypto by playing games.

Ethereum: The Dark Horse Gearing Up for Its “1971 Moment”

While Bitcoin solidifies its role as digital gold, Ethereum is preparing for a transformative leap. Analysts are increasingly bullish on Ethereum, not just as a cryptocurrency but as the foundational platform for the future of finance.

Tom Lee argues that 2025 will be Ethereum’s “1971 moment.” In 1971, the dollar went off the gold standard, forcing Wall Street to innovate new financial products to support it. In 2025, the world will begin tokenizing everything—stocks, bonds, real estate, and more. Wall Street is already building these next-generation financial products on smart contract platforms, and the primary destination is Ethereum.

The on-chain data supports this bullish thesis. Ethereum recently saw its highest daily network growth in history, with nearly 400,000 new wallets created on a single Sunday. Crucially, this growth is occurring while network fees have dropped due to upgrades, and stablecoin transfer volume has soared into the trillions. This indicates new users are arriving for real usage and utility, not mere speculation.

With the potential passage of the FIT21 and Ethereum Clarity Act, regulatory hurdles could diminish, opening the floodgates for further institutional adoption. Lee’s predictions are eye-popping: a Bitcoin price target of $250,000 and an Ethereum target ranging from $12,000 to $62,000, based on historical ratios and its expanding utility.

Navigating the Current Phase: Accumulation, Not Distribution

So how should an investor interpret the current market? The key is to understand market psychology. True market tops are characterized by euphoria and widespread confidence. What we have now is the opposite: fear, uncertainty, and neutral-to-negative sentiment.

- Prices are holding despite negative headlines.

- Sentiment is neutral, lacking the excitement of a bull market top.

- Participation is selective, with smart money accumulating quietly.

This combination often signals digestion and accumulation, not distribution. As one analyst notes, “When accumulation is happening without excitement, it usually means something is building.” Furthermore, Bitcoin is showing technical bottoming signals, moving from a period of net realized losses back into net realized profit—a transition that has marked the start of recoveries in recent years.

[IMAGE:01:20:15] A side-by-side comparison chart showing the price action of gold after its 2004 ETF launch and a projected path for Bitcoin post-ETF.

The parallel to gold’s 2004 ETF launch is instructive. After its ETF was approved, gold entered a consolidation period before embarking on a historic, multi-year “melt-up.” Bitcoin, now institutionalized with its own spot ETFs, may be following a similar script. The major difference? Bitcoin’s supply is programmatically scarce and about to be cut in half, while gold’s supply can be increased through mining.

Conclusion: Patience and Perspective Are Key

The message from analysts is clear: do not be fooled by short-term noise or sensational headlines. The sale by a long-term holder is not a death knell; it’s a milestone in an asset’s maturation. Bitcoin is not broken; it’s growing up. Ethereum is not stagnant; it’s building the infrastructure for a tokenized world.

The current phase may feel uncomfortable, but it is likely the necessary consolidation before the next acceleration. The fundamental tailwinds—institutional adoption, regulatory progress, the halving, and the tokenization revolution—are stronger than ever. For investors, this is a time for strategic accumulation and patience. The overall trend remains your friend, and for Bitcoin, Ethereum, and the broader crypto ecosystem, that trend is decisively pointed in one direction: up. To see how this digital asset revolution is creating new opportunities across the board, check out our monthly roundup of the top play-to-earn games you need on your watchlist. The building continues, and the next chapter is being written now.