Welcome back, crypto enthusiasts. As we navigate a pivotal moment in the markets, Bitcoin is currently retesting a crucial support zone that will determine its short-term trajectory. Meanwhile, major altcoins like Ethereum, XRP, and Solana are showing distinct patterns of struggle and consolidation. This analysis breaks down the critical technical levels, emerging signals from liquidation heatmaps, and what traders can expect over the coming days, especially during the long weekend.

Bitcoin’s Critical Support Retest

All eyes are on Bitcoin as it approaches a decisive moment. The price is currently retesting a vital support area between $92,000 and $94,000. This zone is now acting as a new foundation for the market, and holding above it is paramount for the continuation of the recent bullish trend.

Why is this level so important? A confirmed daily candle close back below $94,000—and especially below $92,000—would be an extremely bearish signal for the following weeks. It would invalidate the recent breakout to the upside and the active inverse head and shoulders pattern, which currently has a technical price target of roughly $103,000.

Conversely, if this area holds as support, the path is cleared for a move toward the next major resistance levels:

– $100,000 (Major psychological and technical resistance)

– $103,000 (Inverse head and shoulders target)

– $106,000 (Additional expected resistance)

The Signals Behind the Short-Term Weakness

The current pullback and choppy price action are not surprising. They are the expected outcome of several technical signals that have been actively playing out.

First, a bearish divergence has been evident on the 6-hour Bitcoin chart. This occurs when the price makes higher highs while the Relative Strength Index (RSI) makes lower highs, indicating waning bullish momentum. This typically results in a slight pullback or sideways movement over a period of days, which is exactly what we’ve seen.

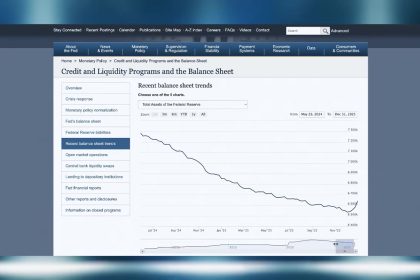

Furthermore, external market factors are contributing to the weekend’s lethargy. As discussed in previous analyses, the closure of the U.S. stock market and Bitcoin ETFs for the weekend (and the Monday holiday) historically leads to reduced liquidity and momentum in crypto markets. This dynamic is a key reason why significant breakouts are less likely over weekends and more probable when traditional markets reopen.

Liquidation Heatmaps and Altcoin Watch

Beyond pure price charts, the Bitcoin liquidation heatmap provides clues about potential short-term price magnets. New levels of liquidity are building close to the current price, suggesting areas the market might be drawn to.

Notably, a cluster of liquidity is forming around $93,500 to $93,700. This suggests a potential quick dip below $94,000 is possible to “take out” this liquidity. However, for the bullish structure to remain intact, the price would need to quickly recover and maintain daily closes above $94,000. A sustained break below would change the narrative.

The altcoin market is largely mirroring Bitcoin’s indecision but with its own critical levels:

- Ethereum (ETH): Similar to Bitcoin, ETH is retesting an important trendline. It is also showing an overbought RSI signal on the 3-hour chart, which calls for a cooldown period of sideways or slightly negative price action.

- Solana (SOL): The price continues to struggle with a formidable resistance zone between $143 and $147. Repeated rejections here indicate that a major breakout is unlikely without a fresh catalyst, potentially later in the new week.

- XRP: This asset is in a particularly precarious position. It is testing crucial support at $2.05 to $2.25. A daily close below $2.00, especially if Bitcoin remains weak, could trigger a fall toward $1.80. XRP desperately needs a resurgence in Bitcoin and broader market strength to avoid a breakdown.

- Chainlink (LINK): Following the general market sentiment, LINK is expected to see similar choppy or weak price action in the short term, with key support at $13.40-$13.50 and major resistance at $14.70-$15.00.

Key Takeaways and Trading Outlook for the Week

The immediate forecast for the remainder of the weekend and the Monday holiday is continued choppy, sideways price action or slight weakness across major cryptocurrencies. This is a natural reset following recent moves and due to lower traditional market activity.

Here’s what to watch as the new week begins:

- Bitcoin’s $94k Hold: The single most important factor. A successful hold above this support keeps the short-term bullish trend and the $103k price target alive.

- ETF and Stock Market Inflows: Watch for resuming Bitcoin ETF inflows and a positive open in the U.S. stock market on Tuesday as potential catalysts to reignite momentum.

- Altcoin Dependency: Altcoins like XRP are at a tipping point. Their next significant move is heavily dependent on Bitcoin finding its footing and pushing higher.

For traders, this environment underscores the importance of risk management and patience. Setting alerts around the key support and resistance levels mentioned can help you react to confirmed breaks rather than intraday noise. Whether you’re looking to position for a continued breakout or hedge against a breakdown, understanding these levels is crucial.

Remember, navigating both bullish and bearish markets requires a solid strategy. For insights on profiting from volatile price action, consider exploring resources on how to identify and trade key market reversals. Furthermore, for those interested in alternative methods of engaging with the crypto ecosystem, there are numerous ways to earn crypto through gameplay without direct market exposure.

In conclusion, the crypto market is at a short-term inflection point. While the longer-term charts still show constructive patterns, the immediate future hinges on Bitcoin’s ability to defend its newfound support. By focusing on these technical levels and market rhythms, you can be better prepared for the week ahead.