Welcome back to The Good Wildtunnel. As we head into a long weekend for U.S. markets, Bitcoin is navigating a critical juncture, retesting a vital support zone while facing renewed sell pressure from Spot Bitcoin ETFs. This short-term weakness is echoed across major altcoins like Ethereum and Solana, setting the stage for a pivotal week ahead. Let’s break down the charts, the data, and what traders should watch for in the coming days.

The Macro Picture: Stocks, ETFs, and Weekend Weakness

The broader financial landscape is setting the tone for crypto. The U.S. stock market saw a decent open yesterday but pulled back throughout the trading day to close a small gap on the S&P 500’s hourly chart. This action has not yet invalidated a concerning bearish divergence, suggesting the market is still struggling in the near term.

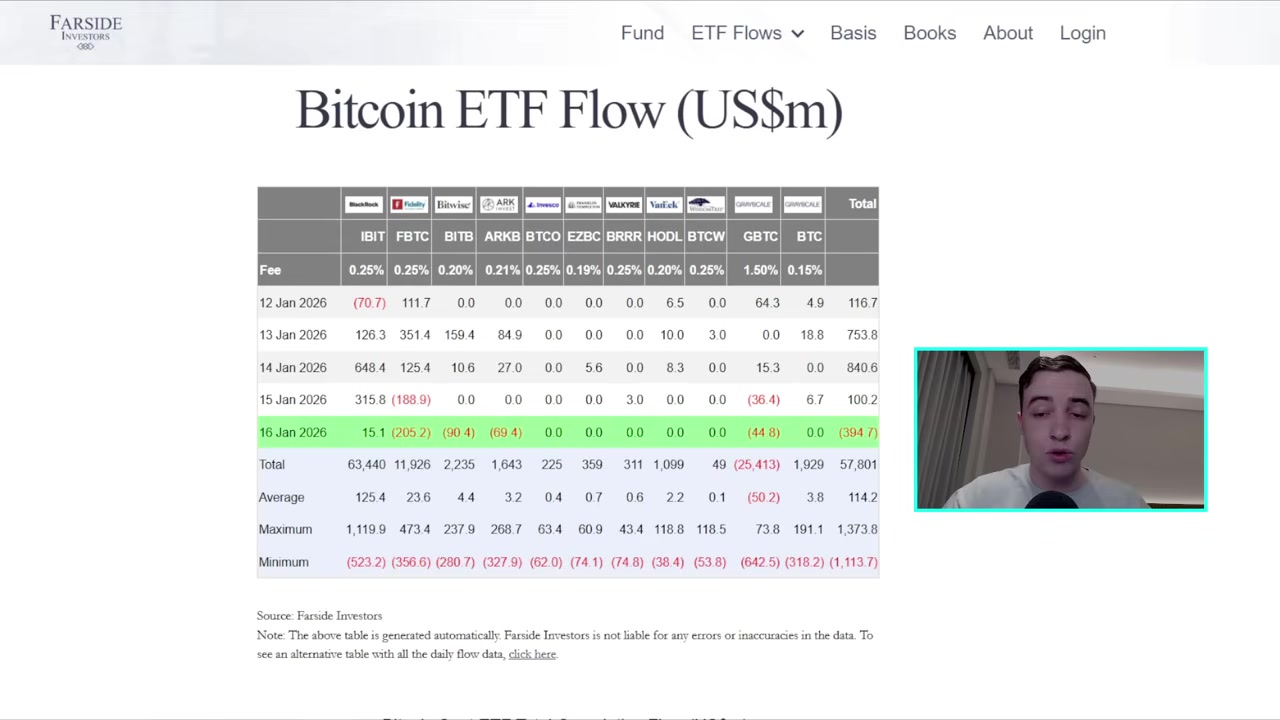

Crucially, this is a long weekend, with markets closed on Monday. This closure means that any potential weakness in traditional markets could spill over into the crypto space, as traders have fewer venues for liquidity and price discovery. The connection is direct: Spot Bitcoin ETFs trade on the U.S. stock market. Their flows are a daily barometer of institutional sentiment, and Friday’s data delivered a notable shift.

After a week of strong inflows—including $753 million on Tuesday and $840 million on Wednesday—the Spot Bitcoin ETFs recorded their first net outflow of the week on Friday, shedding nearly $394 million. This reversal introduces fresh sell pressure as the week closes.

“Because the stock market is closed over the weekend and also will be closed on Monday, we won’t see any new inflows or outflows until Tuesday,” the analysis notes. This creates a vacuum where the last sentiment—net selling—could weigh on prices until traditional finance resumes.

Bitcoin’s Technical Battle: The $94,000 Line in the Sand

Zooming into Bitcoin’s charts, the weekly timeframe shows a complex technical picture. A major bearish divergence on the Super Trend indicator remains in play but is moving closer to a potential invalidation. Countering this is a possible hidden bullish divergence that is starting to confirm. However, a typical divergence is generally more significant than a hidden one, so more confirmation is needed for full confidence.

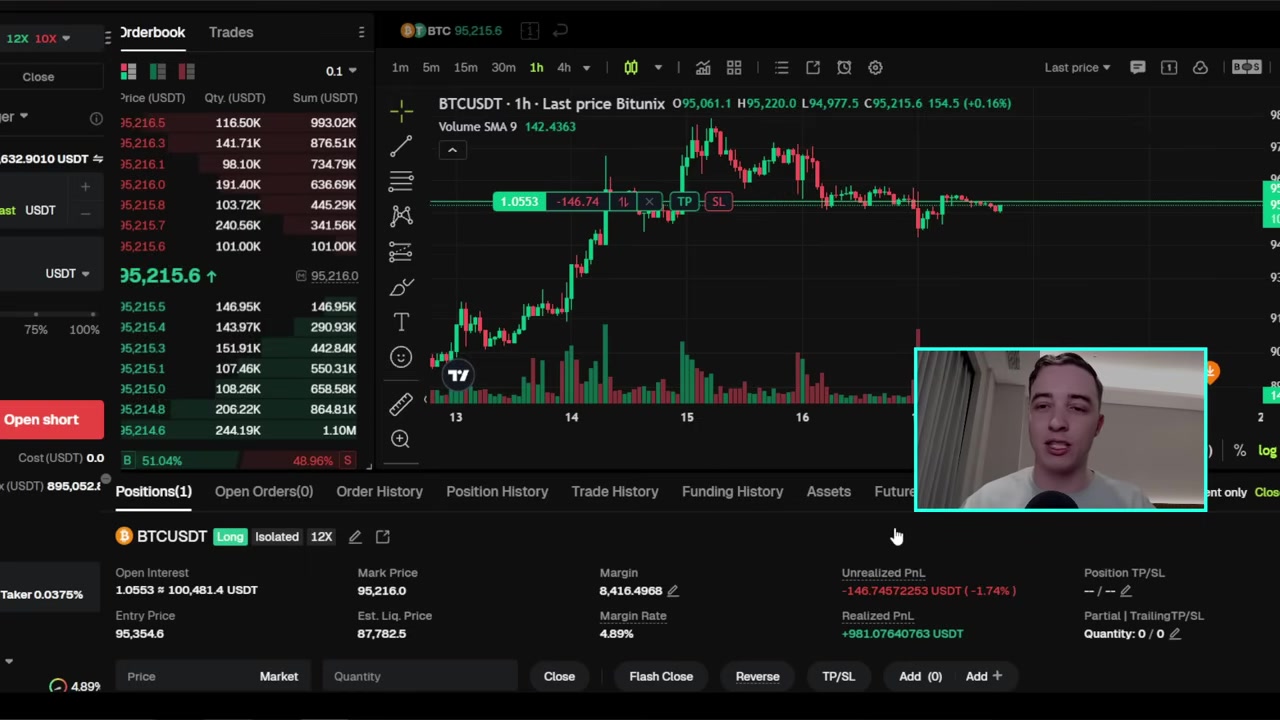

The more immediate and clear battle is on the daily chart. Bitcoin is currently retesting a crucial support zone between $92,000 and $94,000, with the $94,000 level being particularly key. This area was previous resistance and is now acting as new support—a classic bullish structure if it holds.

Technically, an inverse head and shoulders pattern remains active while price holds above $94,000, projecting a technical price target near $103,000. The path higher is not expected to be a straight line. “It’s unlikely we’ll go straight towards that price,” the analysis cautions, expecting choppy action and potential pullbacks along the way.

The short-term six-hour chart reveals the immediate cause of the pullback: an active short-term bearish divergence that was warned about in prior analyses. This is manifesting as the expected “cool-off” or retest of the $94K support.

The key takeaway: For the bullish scenario to remain intact over the next week or two, Bitcoin needs to hold above the $94,000 level. A breakdown here would signal deeper trouble. If support holds and markets recover next week, a continuation toward the $100,000-$103,000 resistance area is likely.

Altcoin Analysis: Ethereum, Solana, and Struggling Majors

The ripple effects of Bitcoin’s consolidation and macro weakness are evident across the altcoin market.

Ethereum (ETH) is in a similar retest phase, bouncing from a crucial support-turned-resistance line on its daily chart. The shorter-term three-hour chart shows its RSI recently hit extremely overbought levels and has since reset—a normal and healthy process within a bullish trend that is still forming higher lows and higher highs. Expect some choppy sideways action or a slight pullback over the weekend, with a potential resumption of upward momentum in the new week when broader market conditions may improve.

Solana (SOL) faces a familiar foe: a stiff resistance zone between $143 and $147. It has struggled at this level for months. While a daily bullish divergence suggests continued retests are likely, a clean breakout over the weekend is viewed with skepticism due to the expected broader market lull. A more confident breakout would require a recovery in Bitcoin and stocks in the new week. If achieved, the next major resistance sits between $166 and $170.

XRP presents a weaker picture. A massive, multi-month bearish divergence on the weekly chart—warned about as far back as July—is still in effect. Price is currently testing a major support area between $2.20 and $2.50 on the daily chart. “XRP is clearly looking quite weak. In fact, even more weak than Bitcoin and other altcoins,” the analysis states. It will likely hold this support over the weekend, but a sustained bounce in Bitcoin and stocks is needed next week to avoid a eventual breakdown.

Chainlink (LINK) is in a somewhat better position than XRP but is still expected to see short-term weakness over the long weekend. Support is found near $13.30-$13.50, with resistance at $14.10-$14.20 and $14.70-$15.00. The expectation is for choppy or slightly lower price action, not a major crash, aligning with the general market cooldown.

Trading Strategy and Key Levels to Watch Moving Forward

Navigating this environment requires patience and a focus on key levels. The long weekend introduces lower liquidity and the potential for exaggerated moves, so caution is warranted.

For Bitcoin:

– Crucial Support: $92,000 – $94,000 (especially $94,000). Holding above is bullish for a move toward $100K+.

– Key Resistance: ~$100,000 and ~$106,000.

– Short-Term Outlook: Expect choppiness or a slight pullback over the weekend, with direction likely to be set when U.S. markets and ETFs reopen on Tuesday.

For Major Altcoins:

– Ethereum: Watch for a hold of support and a reset RSI to signal the next leg up within its bullish trend.

– Solana: The $147 level is the line in the sand for a bullish breakout. Be skeptical of weekend breakouts.

– XRP: The $2.20-$2.50 zone is critical support. A break below could signal significant further weakness.

– Chainlink: Expect sideways to slightly down action over the weekend, with $13.30-$13.50 as important support.

For traders looking to capitalize on these market movements, whether bullish, bearish, or sideways, understanding different position strategies is key. Exploring guides on how to profit from choppy sideways price action or how to set up long and short positions can be invaluable tools in a volatile market.

Conclusion: A Weekend of Watchful Waiting

The crypto market enters the weekend at an inflection point. Bitcoin’s retest of the $94,000 support, combined with the first net outflow from Spot Bitcoin ETFs in a week and a closed traditional market, creates a recipe for short-term uncertainty and potential weakness.

The core bullish thesis for Bitcoin and the broader market remains intact, but it is conditional. The $94,000 support level for Bitcoin is the most important price to watch. Its defense or failure will likely dictate the trend for major altcoins in the week ahead. Traders should prepare for a quiet, possibly shaky weekend, with the real action poised to begin when the bell rings on Wall Street Tuesday morning.

As always in crypto, the trend is your friend until it ends. For those interested in applying this technical analysis to find opportunities, whether in established coins or newer, gaming-focused crypto projects, resources are available. You can explore guides on the top play-to-earn games to watch or learn about free ways to earn crypto by playing games to diversify your engagement with the blockchain ecosystem. Remember, managing risk and having a clear plan for various market scenarios is the hallmark of a disciplined trader.