As Bitcoin continues to dominate the crypto market, holding the asset for appreciation is just the beginning. Savvy investors are now deploying sophisticated strategies to generate income from their Bitcoin holdings while navigating the current bull run. This approach allows for profit-taking, portfolio growth, and risk management without simply selling assets prematurely. From leveraging positions to participating in high-yield liquidity pools, let’s explore the practical methods you can use to make your Bitcoin work harder for you.

- The Foundation: Bitcoin’s Market Dominance and Income Potential

- Strategy 1: Leveraging Bitcoin for Amplified Exposure

- Strategy 2: Yield Farming with Hedged Positions

- Strategy 3: Active Liquidity Provision for Income

- Option A: Bitcoin/Stablecoin Pools (e.g., cbBTC/USDC)

- Option B: Correlated Asset Pools (e.g., Ethereum/wBTC)

- Building a Diversified, Self-Fueling Portfolio

- Conclusion: Taking Control in the Bull Market

The Foundation: Bitcoin’s Market Dominance and Income Potential

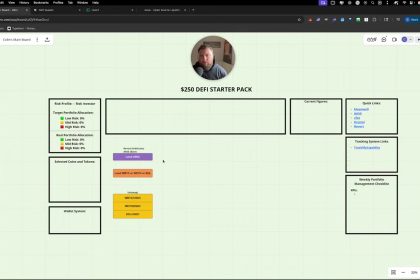

Bitcoin remains the undisputed leader of the cryptocurrency market. We have not yet transitioned into an “Ethereum season” or a broad “alt season,” with Bitcoin currently commanding a total market cap of roughly $2.1 trillion at a price around $105,000. This strong position provides a stable foundation for more advanced financial strategies.

The core idea is to benefit from Bitcoin in two ways: first, from the long-term asset appreciation, and second, from generating short-term income. This dual approach opens a world of possibilities. You can use the income to stack more Bitcoin through a compounding strategy. Alternatively, you can employ it as a profit-taking mechanism, converting generated Bitcoin into stablecoins for fiat withdrawal without selling your core holdings. This is crucial when you’re uncertain where the price will peak, allowing you to take profits gradually and sell your underlying assets at different price points, or use a mixture of both strategies.

Strategy 1: Leveraging Bitcoin for Amplified Exposure

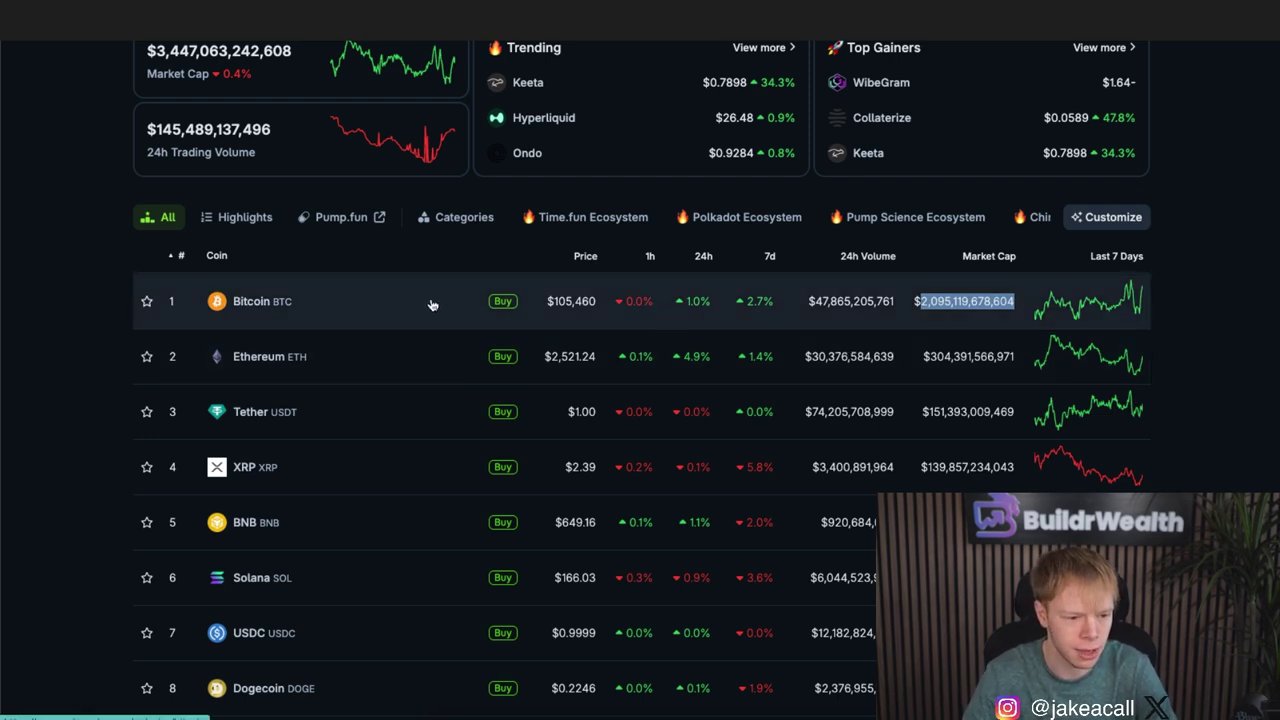

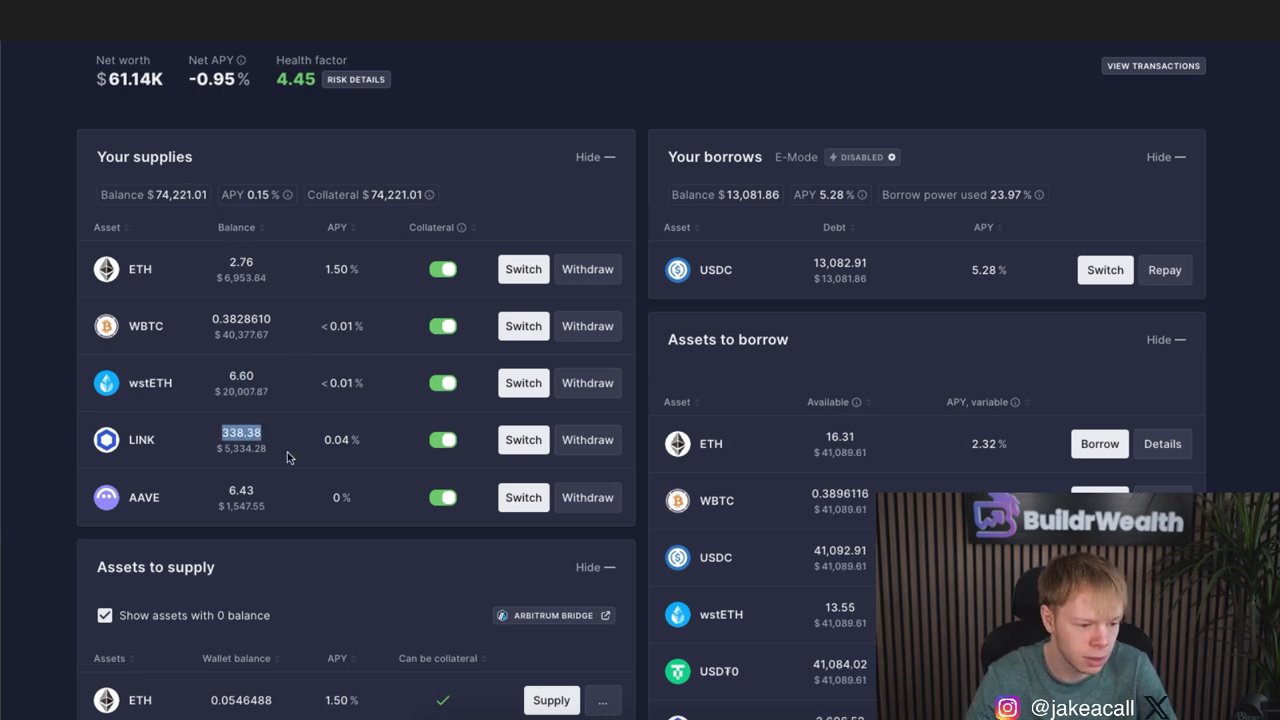

One powerful method to increase your Bitcoin exposure without additional capital is through leverage. Platforms like Aave facilitate this. For instance, you might start with a $20,000 Bitcoin position. By using other assets in your portfolio—such as Ethereum, staked Ethereum, LINK, or AAVE tokens—as additional collateral, you can borrow against your total collateral value.

- Deposit Collateral: Start with your initial Bitcoin and other crypto assets on a lending platform.

- Borrow Stablecoins: Take out a loan in stablecoins against your collateral. The interest rates can be relatively low, around 5% annually.

- Re-invest for Leverage: Use the borrowed stablecoins to purchase more Bitcoin (e.g., via wBTC or a similar wrapped asset). This creates a leveraged long position.

The result? You gain amplified exposure to Bitcoin’s price movement. If you borrow $13,000 and buy more Bitcoin, you might end up with $33,000 of total Bitcoin exposure from an initial $20,000 outlay. You capture all the profit from the upside (and all the losses from the downside), only needing to pay back the initial loan plus minimal interest. For a deeper dive into evaluating platforms and strategies, consider reading The Builder’s Blueprint: A Systematic Approach to Finding High-Yield DeFi Liquidity Pools.

Strategy 2: Yield Farming with Hedged Positions

If you’re hesitant to sell your Bitcoin or are concerned about impermanent loss in standard liquidity pools, a more nuanced strategy exists. You can separate yield generation from market volatility.

- Borrow Against Bitcoin: Similar to the first step in Strategy 1, use your Bitcoin (e.g., wBTC or cbBTC) as collateral to borrow stablecoins.

- Deploy in Delta-Neutral Pools: Instead of buying more Bitcoin, inject those borrowed stablecoins into specialized delta-neutral liquidity pools or hedging strategies. These are designed to minimize exposure to the underlying asset’s price swings.

- Capture Pure Yield: The goal is to hedge out your market exposure. You are essentially borrowing cheap capital (at ~5%) to earn a much higher yield (potentially 50-100% APY) in a hedged environment, capturing the yield while being largely indifferent to price movement.

An example of this in practice could involve a paired position. You might have one position in a high-APR pool that is currently down in dollar value, but simultaneously have a short position on the same asset pair that is up by an equivalent amount. The net market exposure is neutralized, but you still earn the trading fees and rewards from the pool.

Strategy 3: Active Liquidity Provision for Income

For those willing to take on some market risk for higher returns, providing liquidity in decentralized exchanges (DEXs) is a proven method. The key is choosing the right pair and managing your price range.

Option A: Bitcoin/Stablecoin Pools (e.g., cbBTC/USDC)

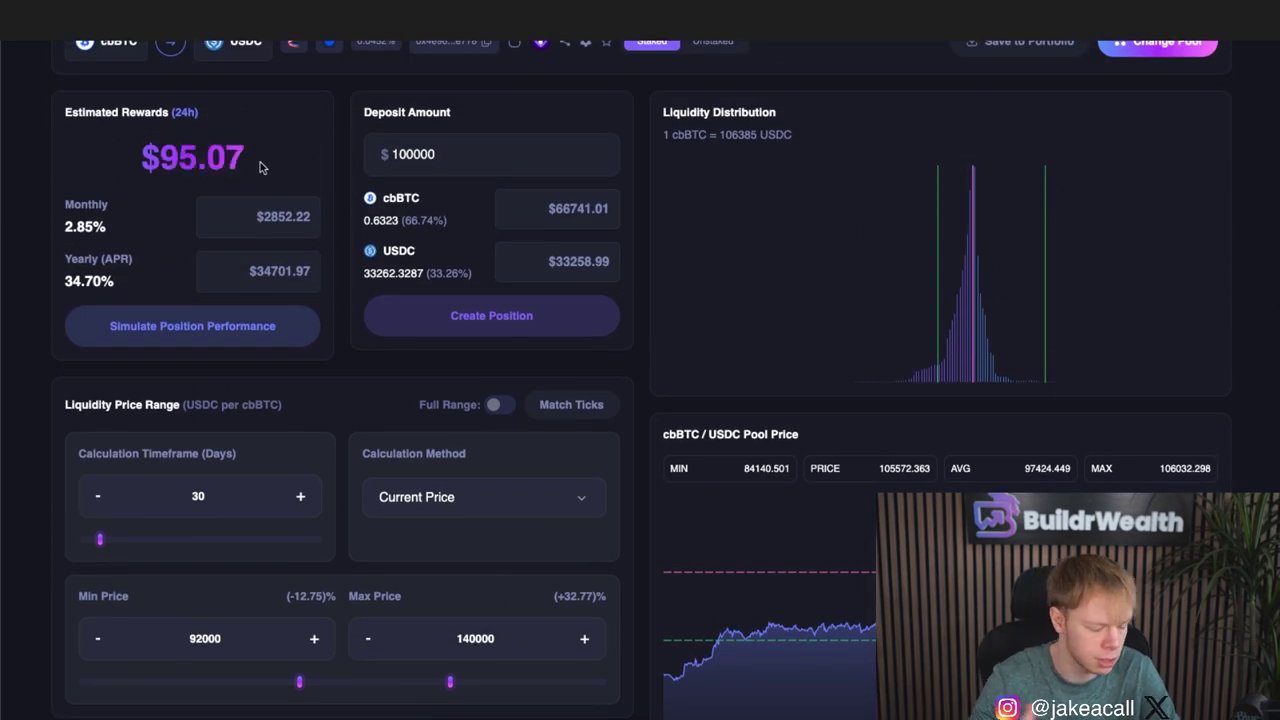

Pools pairing Bitcoin with a stablecoin like USDC are excellent for taking profits while earning fees. This strategy is ideal when you believe Bitcoin is nearing a potential local or all-time high.

- How it Works: You provide an equal value of cbBTC and USDC to the pool. As traders swap between the assets, you earn a percentage of the fees.

- The Trade-off: You do not have full market exposure. If Bitcoin’s price rises, the pool’s automated market maker (AMM) mechanism will automatically sell some of your Bitcoin for USDC. You end up with less Bitcoin but more stablecoin, effectively taking profit on the way up.

- Maximizing Returns: Using concentrated liquidity platforms (like Aerodrome on Base), you can set a tight price range (e.g., $92,000 to $140,000) to increase your fee share and daily returns. A $100,000 position in a high-performing pool could generate around $95 per day.

Option B: Correlated Asset Pools (e.g., Ethereum/wBTC)

For a strategy with full market exposure but less impermanent loss risk, consider pools with two correlated, volatile assets like Ethereum and wrapped Bitcoin.

- The Advantage: Since both assets tend to move in the same general direction (though not perfectly), the impermanent loss is typically lower than in a volatile/stablecoin pair. You maintain exposure to the crypto market’s overall growth.

- Strategic Use: This pool is excellent for gradually laddering from Bitcoin to Ethereum in anticipation of a potential “flip” or period of Ethereum outperformance. It allows you to earn fees while your portfolio slowly rebalances based on market demand.

- Potential Returns: Such a pool can offer substantial APY (e.g., 63%), translating to significant daily income on a large position, all while keeping your capital deployed in top-tier crypto assets.

Building a Diversified, Self-Fueling Portfolio

The most robust approach combines these strategies. You can maintain a diversified portfolio across different asset pairs (e.g., Ethereum/Render, Ethereum/AIOZ) while using the generated yield as a flywheel for your portfolio.

The income you earn from liquidity provision or other DeFi strategies can be continuously re-invested. This acts like automated dollar-cost averaging, injecting capital into your portfolio consistently without requiring new funds from your bank account. Your portfolio does the work for itself, compounding and growing at a faster pace. When combined with traditional dollar-cost averaging or strategic buys during market dips, this flywheel effect can significantly bolster your long-term performance.

Conclusion: Taking Control in the Bull Market

The current Bitcoin bull market presents more than just a holding opportunity. By employing strategies like leveraged exposure, hedged yield farming, and strategic liquidity provision, you can actively generate income, manage risk, and take profits in a disciplined manner. Whether your goal is to stack more sats, create a steady income stream in stablecoins, or prepare for a potential market rotation, DeFi provides the tools. Remember, the key is to start with a clear objective, understand the risks (like liquidation or impermanent loss), and consider diversifying your tactics across several of the methods discussed. By making your Bitcoin work proactively, you position yourself to finish this market cycle stronger. For those looking to apply these principles in a more gamified context, exploring the ecosystem of play-to-earn games on Solana can offer additional, engaging avenues for crypto accumulation.